Advertisement|Remove ads.

BlackSky Technology Is The Latest Space Stock To Grab Investor Attention — Jefferies Expects Sales To Double In A Few Years

- The analyst cited BlackSky’s unique space-based imagery offering and a refreshed constellation by the end of 2026.

- Jefferies expects these to contribute to the company’s topline at about 25% per year.

- It also forecasts the space intelligence company’s sales doubling to $211 million by 2028.

BlackSky Technology Inc. (BKSY) shares rose over 5% in Monday’s premarket trade after Jefferies initiated coverage on the space intelligence company.

Jefferies awarded BlackSky stock a ‘Buy’ rating with a $23 price target, implying a potential 19.5% upside to its current price. The analyst highlighted its unique space-based imagery offering and a refreshed constellation by the end of 2026, expected to contribute to its topline at about 25% per year.

Jefferies expects the company’s sales to double to $211 million by 2028, up from $108 million at present.

Gen-3 Capacity Expansion

On Dec. 17, 2025, the company integrated its third Gen-3 satellite into commercial operations just three weeks after launch, marking an exponential increase in commissioning speed and in high-resolution 35-centimeter imagery, as well as AI-enabled analytics, for its global customer base.

With this development, BlackSky customers have access to all three current Gen-3 satellites through the Spectra tasking and analytics platform. These can collect time-diverse, high-cadence day and nighttime imagery and high-off-nadir collections, with automated AI-enabled vessel, aircraft, and vehicle detection and identification analytics.

How Did Stocktwits Users React?

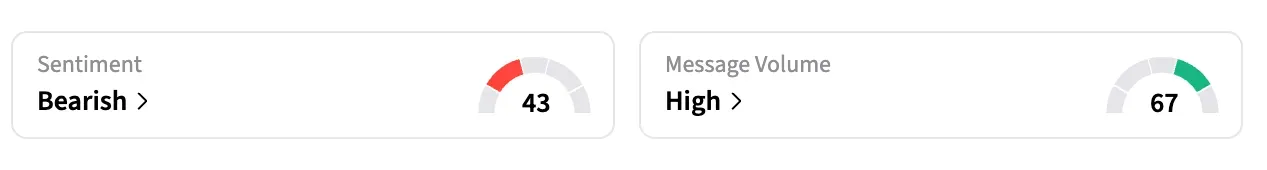

On Stocktwits, retail sentiment around BKSY stock was in ‘bearish’ territory from ‘neutral’ a day ago, and message volume remained at ‘high’ levels at the time of writing.

One user said the company’s outlook looked better.

Shares of BlackSky Technology are up over 85% in the last year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)