Advertisement|Remove ads.

BluSmart Pumps Brake On Operations Amid Gensol Stock's Freefall: Analyst Flags Key Signals To Watch

Shares of Gensol Engineering continued their downward spiral, slipping another 5% on Thursday, hitting a lower circuit for a second straight session.

The sharp erosion in value comes amid escalating regulatory scrutiny

Earlier this week, SEBI barred Anmol and Puneet Jaggi — Gensol promoters and former BluSmart executives — from serving as directors or key managerial personnel over alleged misuse of funds.

The market watchdog claimed that loans raised by Gensol for electric vehicle procurement were diverted for personal use, including purchasing a luxury flat in Gurgaon.

Following the SEBI order, both Jaggi brothers have resigned from Gensol's board.

Meanwhile, BluSmart — once seen as a serious rival to Uber in India's electric ride-hailing space — has begun winding down its operations. The company has reportedly returned hundreds of leased EVs and suspended driver services in several cities.

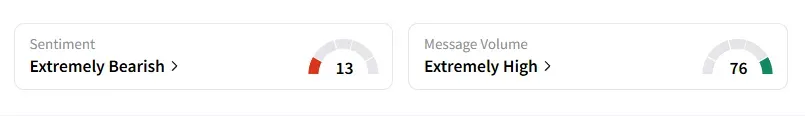

Investor confidence remains shaken, and the data from Stocktwits India reflects that retail sentiment remains 'extremely bearish.'

SEBI-registered analyst Prameela B said on Stocktwits that Gensol remains in a confirmed downtrend.

She added that a solid reversal candle on a daily or weekly chart, improvement in the company's debt position, and clarity from management would be key signals to watch before considering any entry.

The analyst cautioned against attempting to catch the bottom blindly. For now, she pegs the support zone for Gensol at ₹100-110.

Gensol stock has now fallen 85% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235337192_jpg_56c00409cf.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_marvell_logo_OG_jpg_dfc748dd9b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147590_jpg_a31aecbfad.webp)