Advertisement|Remove ads.

Bristol-Myers Squibb Stock Slides On Weak 2025 Outlook, Retail Steps In To Buy The Dip

Bristol-Myers Squibb shares dropped nearly 4% Thursday morning, on track to hit their lowest point in over two weeks.

Despite a strong fourth-quarter (Q4) performance, the company's 2025 outlook disappointed Wall Street, prompting a dip in the stock price.

Bristol-Myers reported Q4 adjusted earnings per share (EPS) of $1.67, surpassing the $1.47 consensus estimate, while revenue came in at $12.3 billion, exceeding expectations of $11.56 billion.

The company highlighted its success with the U.S. approval of Cobenfy, a treatment for schizophrenia in adults, which it expects to become a significant growth driver.

However, the outlook for 2025 was less promising. The company forecasted adjusted EPS between $6.55 and $6.85, below the consensus estimate of $6.92, and 2025 revenue of approximately $45.5 billion, missing the $46.27 billion consensus.

Bristol-Myers reportedly faces increased competition for its older cancer treatments, including Revlimid, Pomalyst, Sprycel, and Abraxane, which are losing exclusivity to cheaper generics.

In response, the company announced plans to generate $2 billion in annual cost savings by the end of 2027 through an expanded strategic productivity initiative to streamline operations and enhance efficiency.

The company plans to invest in growth brands and promising scientific areas while offsetting revenue losses from key drugs like the blood thinner Eliquis and cancer immunotherapy Opdivo.

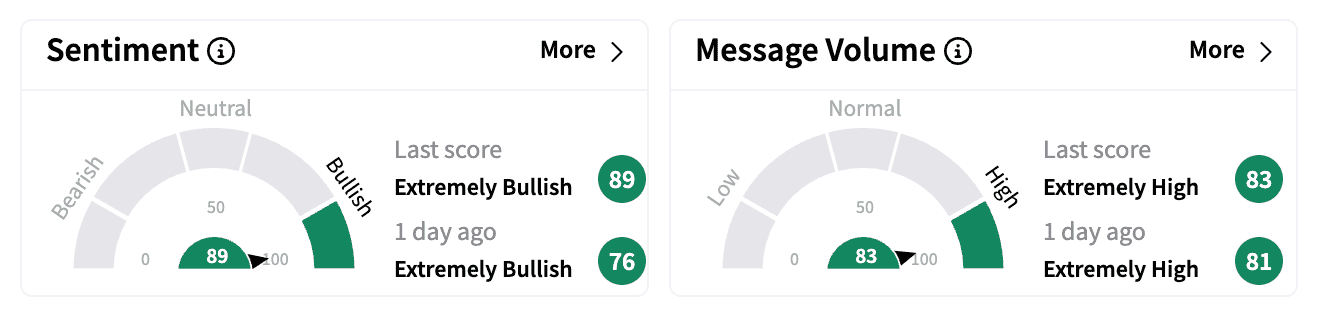

Despite the weaker guidance, retail investors on Stocktwits remained optimistic, with sentiment reading as 'extremely bullish' at the market open.

Some highlighted the potential for annual earnings to climb to $7 per share, with a long-run price target of $100 for the stock.

Others noted that scaling back projections is common in the current economic climate and viewed the earnings report as not particularly bad.

Bristol-Myers trades at a forward price-to-earnings multiple of 8.9, about 3.3% below analysts' average price target of $61.72, according to Koyfin.

The stock has gained over 24% in the past 12 months and is up nearly 5% in 2025 as of Wednesday's close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)