Advertisement|Remove ads.

BNP Paribas Sees 30% Upside For META Stock, Initiates Coverage With ‘Outperform’ Rating: Report

- The analyst said that Meta may increase capital spending faster than rivals and direct more of its revenue toward AI.

- Meta is facing challenges in proving Meta AI assistant’s strengths, which lag behind ChatGPT and Gemini.

- META just posted its strongest intraday gain since August 4 on Monday.

BNP Paribas initiated its coverage of Meta Platforms Inc. (META) with an ‘Outperform’ rating and a price target of $800, implying a 30% premium to the current stock price.

At the time of writing, META stock was trading up over 3%.

BNP Paribas analyst Nick Jones wrote in a note that Meta, which is improving its ability to monetize its three billion users, can afford to aggressively invest in AI to stay ahead of competitors and strengthen its leadership in social media and social commerce.

Jones noted that Meta could boost capital spending faster than competitors and devote a larger share of its revenue to AI expenses. The analyst said the investment is necessary to stay competitive and should pay off in the long run, according to a MarketWatch report on Monday.

“We believe return on these investments will be significantly higher over time than [their] cost and can accelerate Meta’s growth,” Jones wrote. “In our view, the near-term elevated capital expenditure, and resulting margin pressure, is necessary for Meta to solidify its competitive position in the AI race.”

The Challenges

Meta is facing challenges in proving the strength of its Meta AI assistant, which remains smaller in scale than rivals like OpenAI’s ChatGPT and Alphabet’s Gemini, Jones noted. While Meta AI is free, it has yet to match the performance of competing models, and Meta’s Llama model continues to rank poorly in industry comparisons, he added.

“The competition in building a foundation model is intense and we think Meta has fallen behind its competitors,” Jones wrote.

However, he remains optimistic that Meta can continue to improve AI monetization and gain digital advertising market share, supported by strong scale, demand, and targeting capabilities. “Ad pricing is expanding even as ad loads are increasing, reflecting robust advertiser demand,” he wrote.

How Did Stocktwits Users React?

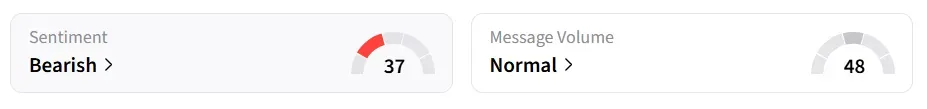

Despite the intraday gains, retail sentiment on Stocktwits remained in the ‘bearish’ territory for the past 24 hours.

META stock has been on a downtrend lately, declining in seven of the past 10 sessions. Despite this, META posted its strongest intraday gain since August 4 on Monday.

Year-to-date, the stock has gained around 4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1238344200_1_jpg_9ec6a1a77a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_aurinia_pharmaceuticals_jpg_021df4af64.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2235745938_jpg_f29c2bc96f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244949316_jpg_a5294e121e.webp)