Advertisement. Remove ads.

BNY Mellon’s Strong Q3 Earnings Pushes Stock To Intraday Record Highs, Retail Sentiment Soars

Shares of BNY Mellon pared their morning gains after hitting fresh record highs on Friday following the release of the bank’s third-quarter (Q3) results.

BNY’s Q3 profit rose 14% year-on-year (YoY) to $1.19 billion, and adjusted earnings per share (EPS) came in at $1.52, versus analyst estimates of $1.4. Revenue rose 5% to $4.65 billion compared to last year, beating consensus estimates of $4.54 billion.

The lender’s assets rose 14% YoY, exceeding $50 trillion for the first time. The jump was driven by higher market values, client inflows and net new business, the firm said. As of the end of the third quarter, the bank’s assets under custody and administration amounted to $52.1 trillion.

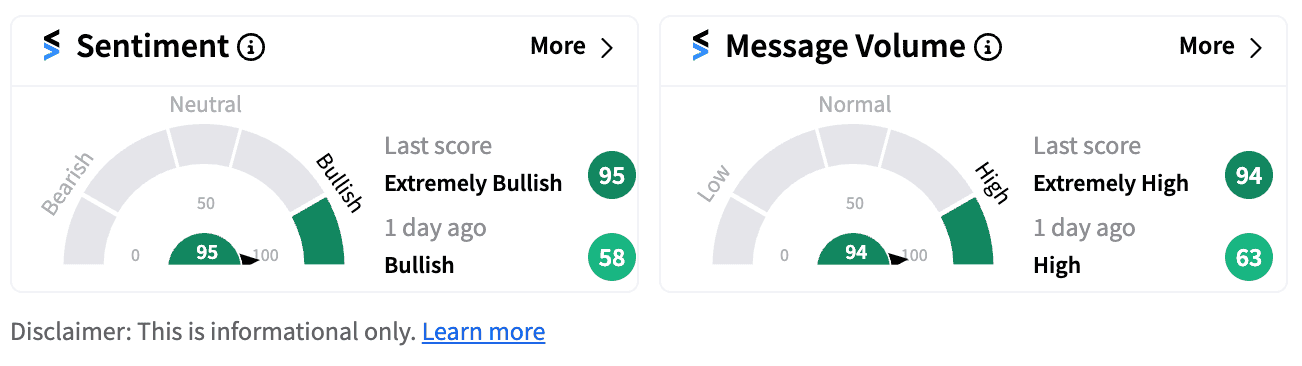

Following the announcement, retail sentiment inched up into the ‘extremely bullish’ territory (95/100), accompanied by ‘extremely high’ message volumes.

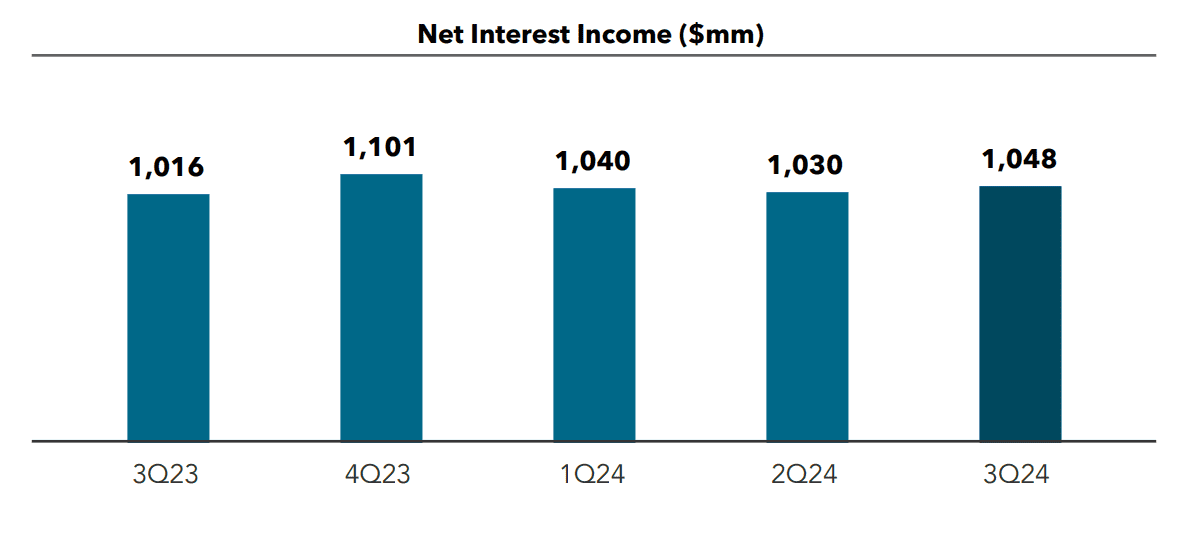

BNY reported a 3% rise in its net interest income (NII) to $1.048 billion during the quarter. The figure beat analyst expectations of a 1.3% drop, Reuters reported citing estimates by LSEG. The bank’s investment services fees rose 5% year-on-year.

Stocktwits users welcomed the news of the bank’s strong earnings:

BNY’s Tier 1 capital or core capital, which is a measure of the bank’s strength, stood at $24 billion and increased by $966 million quarter-on-quarter.

BNY announced a quarterly common stock dividend of $0.47 per share, payable on Nov. 1, 2024 to shareholders as of Oct. 21, 2024. The bank also announced steep dividends for its preferred stock holders – $1,425.70 per share on the Series A Preferred stock; $925.00 per share on the Series H preferred stock; and $937.50 per share on the Series I preferred stock.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/10/biogas.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/air-india-a350-900-2024-11-2a018689c22e8e313593c4b76845dbc8.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/11/swiggy-zomato-2024-11-abc7dc409c45ae64aa63306af7904262.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/08/shutterstock-2162617539-2025-08-b6396e634f55857935c2208abb72fdf6-scaled.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)