Advertisement|Remove ads.

Banzai International Stock Soars 150% As Retail Turns ‘Extremely Bullish’ Amid Debt Restructuring

Shares of Banzai International, Inc. (BNZI), which engages in the provision of data-driven marketing and sales solutions, skyrocketed nearly 150% on Tuesday, making it the top gainer of the day.

The surge came after the company announced it had reached agreements to write off up to $5.6 million in outstanding liabilities and restructure an additional $19.2 million in debt obligations.

In total, Banzai anticipates reducing and restructuring $28.8 million in liabilities, including a previously executed fee restructuring with Cantor Fitzgerald.

The debt overhaul includes eliminating approximately $15.3 million through private placement and restructuring, with insiders like Alco Investment Company participating in the process.

The company recently executed a one-for-fifty reverse stock split to comply with Nasdaq’s minimum closing share price requirement.

Still, BNZI stock remains down 88% year-to-date.

In a positive sign of business momentum, Banzai added 147 new customers in August, bringing its total to 1,434 for 2024 — an increase of 24% over the same period last year. The company’s AI-driven platform has been pivotal in driving strong organic growth.

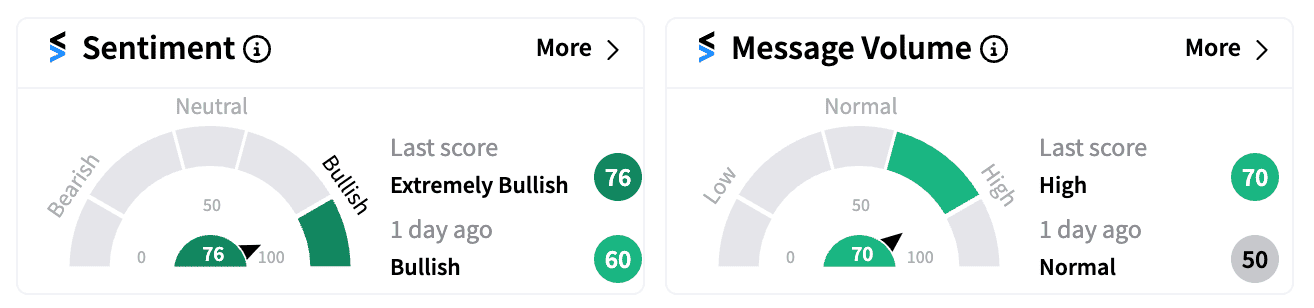

Retail sentiment on Stocktwits turned ‘extremely bullish’ (79/100) following the debt news, with high message volume reflecting heightened investor interest in the stock.

However, Banzai’s financials remain a bit worrisome, with cash reserves of just $1 million as of March 31, 2024.

The company’s ability to navigate its debt restructuring and maintain growth will be key factors to watch in the coming quarters.

Read next: Blackstone, Vista Equity Partners To Take Smartsheet Private In $8.4B Deal: Retail Turns Euphoric

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_canopy_growth_weed_resized_6896927dba.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nasdaq_original_jpg_ad4cc4a377.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1945576902_jpg_e7dd5c5f55.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elon_musk_jpg_47f13afbba.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_mattel_office_resized_jpg_3d4efae2dc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/gettyimages_2247460638_594x594_jpg_a94bad9078.webp)