Advertisement|Remove ads.

Blackstone, Vista Equity Partners To Take Smartsheet Private In $8.4B Deal: Retail Turns Euphoric

Funds managed by Blackstone Inc (BX) and Vista Equity Partners are set to acquire software-as-a-service provider Smartsheet (SMAR) in an all-cash transaction valued at approximately $8.4 billion. Shares of Smartsheet rose over 6% on Tuesday following the announcement.

Under the agreement, Blackstone and Vista Equity Partners would acquire all the outstanding shares held by Smartsheet shareholders for $56.50 apiece in cash — a price that represents a premium of approximately 41% to the volume weighted average closing price of Smartsheet stock for the 90 trading days ending on July 17, 2024.

Given that Smartsheet went public at $15 per share in 2018, the transaction reflects over 3.5x gains in about six years.

Blackstone said it will invest in Smartsheet through its flagship private equity vehicle and its private equity strategy for individual investors.

The transaction is expected to close in the fourth quarter of Smartsheet’s fiscal year ending Jan. 31, 2025, subject to Smartsheet shareholder approval. Blackstone executives said “across increasingly distributed, cross-functional and global workforces, Smartsheet’s innovative and market-leading solutions are mission-critical in helping teams collaborate at scale to achieve superior results.”

Following the completion of the transaction, Smartsheet’s Class A common stock will no longer be listed on any public market and it will become a privately held company. The company will continue to operate under the Smartsheet name and brand.

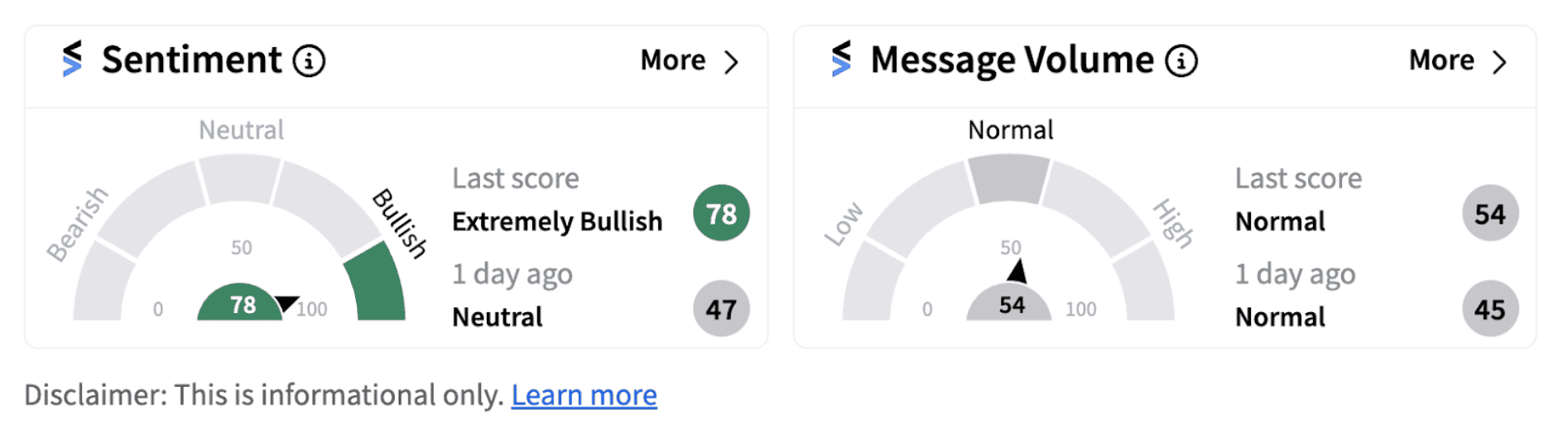

Following the announcement, retail sentiment for Smartsheet jumped into the ‘extremely bullish’ territory from the ‘neutral’ zone’ a day ago.

Blackstone said the agreement for the transaction includes a 45-day “go-shop” period that expires on Nov. 8. During this period, Smartsheet and its advisors will be permitted to actively solicit alternative acquisition proposals from certain third parties, and enter into negotiations for alternative acquisition proposals.

The Smartsheet board will have the right to terminate the merger agreement to accept a superior proposal during this period.

Stocktwits users are wondering whether the firm will see a better bid in the “go-shop” period.

Smartsheet shares have gained over 18% since the beginning of the year. The stock is likely to see a lot of volatility in the coming weeks if the firm receives interest from other prospective buyers.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246067096_jpg_17cd5dd258.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Carnival_Corp_jpg_6bfadbdfb2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1922680024_jpg_60c9f5678d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2179601835_jpg_034e692fb1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_canopy_growth_weed_resized_6896927dba.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_f_150_lightning_jpg_311100907b.webp)