Advertisement|Remove ads.

Boeing’s New CEO Lifts Retail Sentiment Into ‘Bullish’ Zone After Day 1 On Job: What’s He Doing?

Boeing Co. (BA) is experiencing a much-needed shot of optimism, as its stock price surged over 3% on the very first day of new CEO Kelly Ortberg's tenure. Retail investors too seem to be buying into the planemaker’s new chapter.

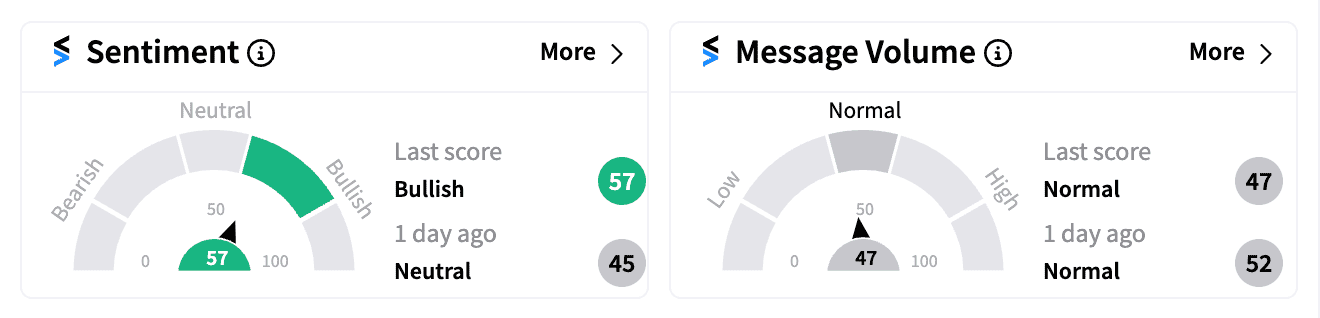

Stocktwits sentiment for BA has flipped from ‘neutral’ to ‘bullish’ (57/100) in a day, indicating a newfound confidence in Boeing's future, which appears to be driven by a combination of Ortberg's strategic decisions and a yearning for change among investors.

Ortberg has decided to relocate his office to Seattle, the company's historical heartland. This move, seen as long overdue by many, signifies a return to Boeing's manufacturing roots.

The CEO himself emphasized the importance of proximity to production in a letter to employees, stating, "We need to get closer to the production lines and development programs."

He wasted no time putting his words into action, reportedly spending his first day on the factory floor in Renton, Washington, the birthplace of the troubled 737 Max planes.

Retail investors on Stocktwits, where Boeing has 185,000 followers, showered praise. One user lauded Ortberg’s focus on safe production increases, highlighting it as the key to unlocking a domino effect of positive outcomes for salaries, stock price, and debt reduction.

Others pointed to Ortberg's engineering background as a perfect fit for leading a manufacturing giant, predicting a significant rise in stock price within the next few years.

Boeing has undeniably faced its share of struggles in recent years. From quality issues that led to fatal crashes to more terrifying incidents such as a door plug blowing off a fuselage mid-air, the company's reputation has taken a beating.

Calhoun, Ortberg's predecessor, inherited a crisis-ridden Boeing in 2020 and saw the stock price nearly halve during his tenure. The COVID-19 pandemic exacerbated the company's woes.

However, analysts like Noah Poponak of Goldman Sachs see a glimmer of hope. Earlier this week, he acknowledged the turbulence of Q2 2024 but highlighted increased production rates and Ortberg's appointment as factors that could alleviate past uncertainties. Poponak maintained a ‘Buy’ rating for BA stock, albeit with a slightly lowered price target.

The combined factors of Ortberg's strategic moves, retail investor optimism, and analyst support are painting a cautiously optimistic picture for Boeing's future.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228901342_jpg_7365e02c40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218742693_jpg_8d1b39840a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)