Advertisement|Remove ads.

Boeing Stock: Analysts See Limited Fallout After China Reportedly Suspends Deliveries, Retail Unfazed

Boeing Co. stock (BA) fell more than 2.3% on Tuesday and slipped after hours following reports that China ordered its airlines not to take any further deliveries from the U.S. planemaker amid the ongoing trade war.

Wall Street analysts and retail investors largely shrugged off the potential impact of this move.

Bloomberg reported, citing sources familiar with the matter, that Beijing has also asked Chinese carriers to freeze purchases of aircraft-related equipment and parts from U.S. companies.

According to The Fly, Morgan Stanley sees "minimal downside risk for Boeing compared to 10 years ago," when China accounted for about 20% of deliveries in a given year.

The research firm said the Asian powerhouse had not ordered many Boeing aircraft in the past few years, with Chinese demand comprising less than 6% of Boeing's total order book in 2025-2028.

It maintained an 'Equal Weight' rating and a $175 price target on Boeing shares.

BofA analyst Ronald Epstein said China's stance on Boeing isn't surprising but called the situation "unsustainable," noting Airbus likely can't be the country's sole large jet supplier due to capacity limits.

If the freeze persists or China cancels orders, Boeing should be able to redirect aircraft to other markets needing capacity, with India being a likely candidate, Epstein said.

BofA maintained a 'Neutral' rating and a $185 price target on Boeing shares.

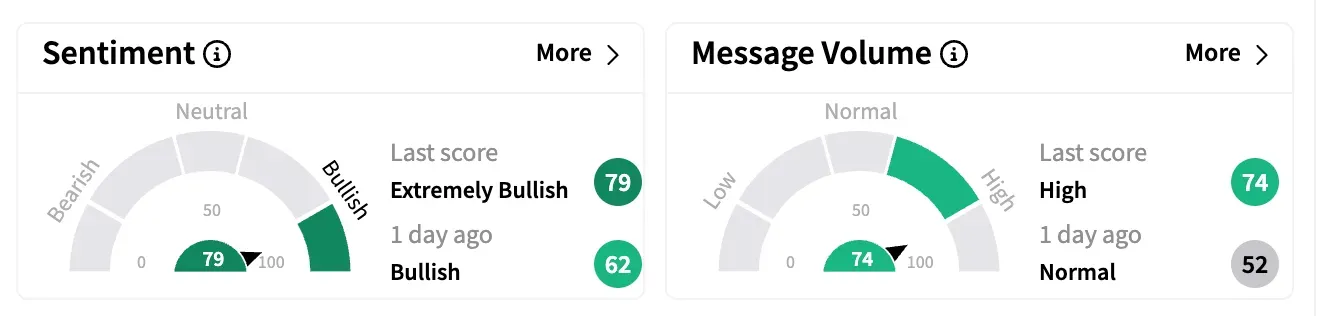

On Stocktwits, sentiment for Boeing ended on an 'extremely bullish' note late on Tuesday, with message volume surging by 736% to make BA among the top 20 trending tickers on the platform.

One user, who also thinks Boeing could redirect orders to India, said: "China has paid 66% of the price of those planes as deposits and progress payments. Who is China hurting if they default on the contract? Certainly not Boeing."

Another optimist believed China and the U.S. would "shake hands soon, and are only in negotiations."

However, there were voices of caution amid an uncertain macroeconomic environment.

Wells Fargo lowered its price target on Boeing to $111 from $113 while keeping an 'Underweight' rating, as it believes a global economic slowdown may reduce global aircraft demand by 300 basis points.

Boeing stock is down over 12.7% this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)