Advertisement|Remove ads.

Booking Stock Rises Premarket As Results, Forecast Raise Boost Travel Outlook

- Booking Holdings reported Q3 results above expectations and lifted its annual revenue outlook.

- The company said travel trends were upbeat, with a recovery in its U.S. business following brand awareness initiatives.

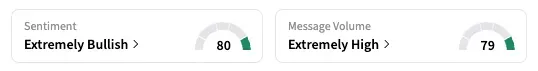

- Stocktwits sentiment for Booking shifted to ‘extremely bullish.’

Booking Holdings, Inc.’s stock rose 4% in early premarket trading on Wednesday, with Stocktwits sentiment ticking higher, following the online travel firm’s upbeat quarterly results and a raise in its full-year outlook.

The Norwalk, Connecticut-based company’s revenue grew 13% to $9 billion in the third quarter, driven by an 8% growth in room nights and 14% growth in travel bookings. Analysts were expecting a topline of $8.73 billion.

Steady travel demand, including for corporate travel, and preference for Booking’s packages boosted the company’s results, it said. Net income rose 9% to $2.7 billion, and adjusted EPS of $99.50 was higher than analysts’ estimate of $95.85.

"While there remains some uncertainty in the macroeconomic and geopolitical backdrop, we're pleased to see continued momentum with steady travel demand trends," Chief Financial Officer Ewout Steenbergen said on the analyst call.

For 2025, it now expects revenue growth of “about 12%” from a 10% to 12% range it had issued earlier, and room nights growth of “about 7%” from a 4% to 6% range.

On Stocktwits, the retail sentiment shifted to ‘extremely bullish’ as of early Wednesday, from ‘bullish’ the previous day. Message volume in the past 24 hours rose 540%.

“$BKNG like clockwork everytime...easiest bet out there,” said one user.

Notably, the company's results showed a rebound in U.S. travel trends. Revenue in the U.S. grew faster during the third quarter, driven by stronger outbound travel and momentum in Booking's business-to-business segment, management said.

"What we're seeing is clearly a pay-off of our brand awareness that is getting stronger in the U.S.," Steenbergen said. "More familiarity and therefore more customers coming now direct to us."

Year-to-date, the BNKG stock is up 3.1%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Amazon Bets Big On South Korea With $5B AWS Data Center Plan Amid Trump's Asian Tour

/filters:format(webp)https://news.stocktwits-cdn.com/large_circle_stablecoins_original_jpg_b238d12be8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_OG_2_jpg_f92901a0f5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786698_jpg_4d7b65921f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Shift4_logo_jpg_jpg_1845f04c23.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)