Advertisement|Remove ads.

Box Stock Surges Post Strong Q1, Wall Street Lifts Price Target: Retail’s Exuberant

Shares of cloud-based tools developer Box Inc. (BOX) surged 11% in Wednesday’s premarket session after reporting better-than-expected first-quarter (Q1) earnings.

The company’s Q1 revenue climbed 4% year-on-year (YoY) to $276 million, beating the analyst consensus estimate of $274.7 million, as per Finchat data.

The adjusted earnings per share (EPS) of $0.30 surpassed the consensus estimate of $0.26.

Following the earnings, Wall Street analysts raised their price targets and professed their confidence in the company’s performance.

Raymond James increased its price target on Box to $42, up from $38, while maintaining an ‘Outperform’ rating.

In a note to investors, the research firm highlighted strong Q1 results, pointing to a notable uptick in billings driven by growth in the enterprise advanced plan.

Raymond James believes that updated pricing and momentum in the Systems Integrators channel may serve as potential catalysts for the stock in the coming months.

Morgan Stanley analyst Josh Baer raised the firm's price target to $38 from $35, while maintaining an ‘Equal Weight’ rating.

In a note following the company's earnings, Baer noted that Q1 billings significantly exceeded expectations, though roughly 400 basis points of that performance were driven by early renewals.

He added that while the outlook reflects greater caution around macroeconomic conditions, limiting upward estimate revisions, it also creates a more favorable foundation for future performance.

JPMorgan analyst Pinjalim Bora increased the stock’s price target to $39 from $37 and reiterated an ‘Overweight’ rating.

In a research note, Bora told investors that Box had a solid start to the year, with key forward-looking indicators gaining momentum.

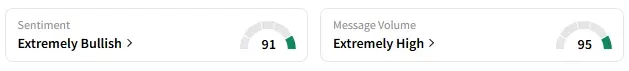

On Stocktwits, retail sentiment around Box changed to ‘extremely bullish’ from ‘bullish’ the previous day.

Box stock has lost 0.5% year-to-date and gained over 25% in the last 12 months.

Also See: Honeywell To Shake Up Board With Elliott Appointee, Says Report: Retail’s Not Yet Bullish

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_walmart_OG_jpg_8a74984dc4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347001_jpg_8286032c70.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_540198451_jpg_3e5f3d8ee7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lemonade_resized_jpg_fe42e63791.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)