Advertisement|Remove ads.

Honeywell To Shake Up Board With Elliott Appointee, Says Report: Retail’s Not Yet Bullish

Honeywell International Inc. (HON) is preparing to appoint an executive from activist investor Elliott Investment Management to its board, as the industrial giant moves forward with a planned three-way corporate split.

According to a report from the Wall Street Journal, Marc Steinberg, a partner at Elliott, will join Honeywell as an independent director and serve on the board’s audit committee by the end of this month.

The appointment marks a significant development in Honeywell’s relationship with Elliott, which had previously urged structural changes at the company.

Elliott, which oversees funds with a stake exceeding $5 billion in Honeywell, has prodded the company’s board to streamline its operations by dismantling its conglomerate structure.

In a letter to the board last November, Elliott argued that simplification is key to restoring value for shareholders and enhancing operational performance.

The investment firm criticized the company's recent track record, citing inconsistent earnings, uneven execution, and lagging stock performance.

The activist investor proposed separating Honeywell’s Aerospace and Automation divisions into standalone companies, allowing each entity to benefit from more focused leadership, clearer strategic priorities, better capital allocation, and stronger operational oversight.

Consequently, Honeywell announced its decision to fully separate the Automation and Aerospace Technologies divisions. Combined with its earlier plan to spin off the Advanced Materials unit, the move will create three independent, publicly traded companies.

The split is expected to be completed by the second half of 2026 through a tax-free structure for its shareholders.

In April, Honeywell raised its adjusted earnings per share (EPS) guidance for 2025 to $10.20 to $10.50, incorporating the net expected impact of current tariffs, mitigation actions, and global demand uncertainty.

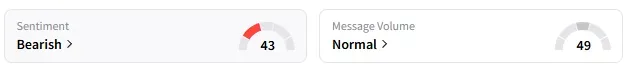

On Stocktwits, retail sentiment around Honeywell remained in ‘bearish territory’.

Honeywell stock has gained only 0.2% year-to-date and over 13% in the last 12 months.

Also See: Nvidia’s Much-Awaited Q1 Report Will Likely Reveal Dent From China Chip Curbs — Retail’s Guarded

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Data_center_jpg_5f0fa8e828.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_battery_swap_jpg_de98f34bea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_michael_saylor_strategy_2013_resized_jpg_e358c15fd4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1760545615_jpg_9507fd561a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)