Advertisement|Remove ads.

This Financial Services Firm Lost Over Half Its Market Cap On Monday — Retail Vents Frustration

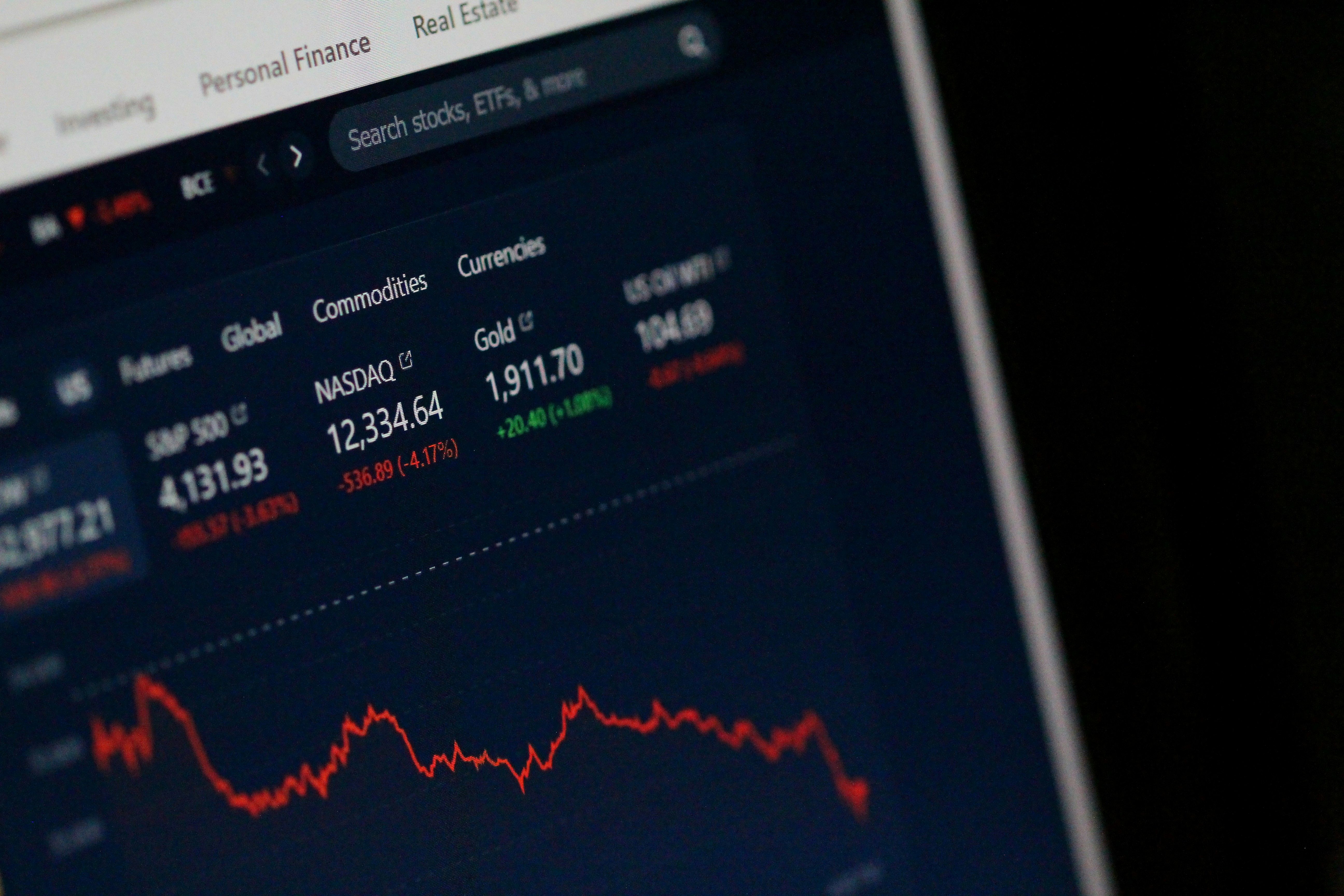

Investment banking service provider B. Riley Financial Inc lost over half its market capitalization on Monday after the firm disclosed its preliminary second quarter results saying it is suspending its dividend while projecting a net loss for the quarter-ended June.

Shares of the firm fell over 55% by Monday noon after B. Riley said it will be suspending its common dividend as it prioritizes deleveraging. The company indicted that net loss for the quarter-ended June 30, 2024 is expected to be in the range of $435 to $475 million, or $14 to $15 per diluted loss per share. During last year's Q2, the firm reported $46.38 million in net profit or EPS of $1.55 per share.

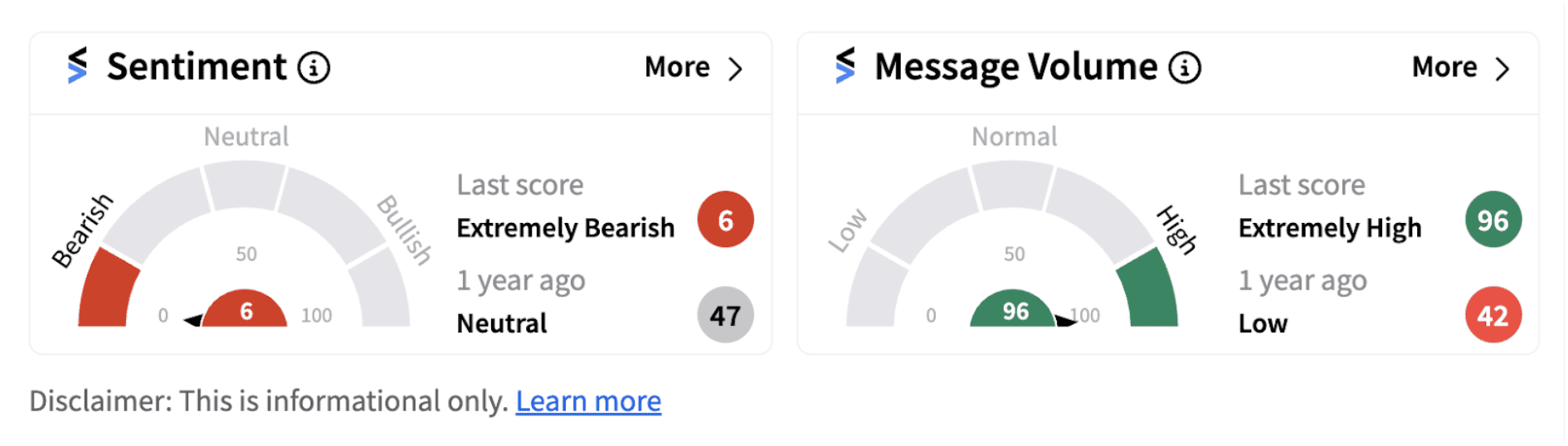

Following the disclosure, retail sentiment on Stocktwits plunged to the “extremely bearish” zone (6/100) from the “neutral” zone a day ago. This was accompanied by “extremely high” message volumes (96/100), which hit a nine-month high.

Chairman and co-CEO Bryant Riley said earnings were negatively impacted by non-cash losses, the overwhelming majority of which relate to performance of the firm’s investment in Franchise Group, Inc. and its Vintage Capital loan receivable, which is primarily collateralized by equity interests in FRG.

The company now expects to report a non-cash markdown of approximately $330 to $370 million related to its investment in Freedom VCM, the indirect parent entity of FRG, and the Vintage Capital loan receivable.

B. Riley also announced its intention to file a Form 12b-25 with the SEC, notifying of a delayed submission of its quarterly report (Form 10-Q) for the June-quarter, citing ongoing efforts to finalize valuations of certain loans and investments.

Stocktwits users were extremely disappointed with the announcement. With the stock currently trading at $7.63, some users are speculating it will dip below the $5-mark.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250240977_jpg_5b777d96ef.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2206295220_jpg_1057588802.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2247614893_jpg_e1dcf2d2f6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sound_Hound_jpg_7961ee756a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2191702229_jpg_e9b50f268b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)