Advertisement|Remove ads.

Bristol Myers Wins Dismissal Of Class Action Lawsuit Accusing It Of Fraudulently Acquiring Patents – Retail Sentiment Remains Subdued

Shares of biopharmaceutical company Bristol Myers Squibb (BMY) were in the spotlight on Wednesday morning after the company won the dismissal of a proposed class action accusing it of fraudulently obtaining patents.

Reuters reported that U.S. District Judge Edgardo Ramos in Manhattan said the health insurer Blue Cross Blue Shield of Louisiana and other purchasers of its blood cancer drug Pomalyst failed to show that Bristol Myers and Celgene Corp, which was acquired by Bristol-Myers Squibb in 2019, violated the federal Sherman antitrust law.

The plaintiffs in the lawsuit claimed that they had been overcharged for Pomalyst since at least October 2020.

They alleged that generic versions of the multiple myeloma treatment could have been launched if not for Bristol Myers filing sham patent lawsuits to maintain an illegal monopoly on Pomalyst.

However, the judge held that the drug purchasers failed to establish fraud in how the company procured six patents related to Pomalyst, as per the report.

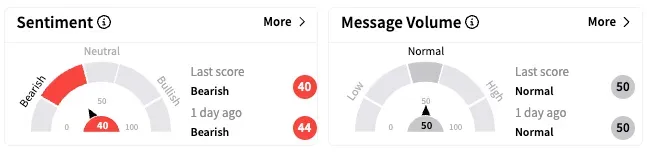

On Stocktwits, retail sentiment around Bristol Myers fell further in the ‘bearish’ territory (40/100), while message volume remained unmoved at ‘normal’ levels over the past 24 hours.

Shares of the company traded over 4% lower in premarket on Wednesday after Trump announced plans to announce a “major” tariff on pharmaceutical imports on Tuesday.

“We are going to be announcing very shortly a major tariff on pharmaceuticals,” Trump said at a fundraising gala for House Republicans, as reported by Bloomberg. The U.S. President didn't provide further details.

Goldman Sachs downgraded Bristol Myers to ‘Neutral’ from ‘Buy’ on Tuesday with a price target of $55, down from $67, according to TheFly.

BMY shares are down by nearly 7% this year but up by about 3% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_fiverr_resized_b6733a31a5.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2261643084_jpg_6360b6a821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Quantum_Computing_jpg_8d3aa87e51.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_capitol_building_OG_jpg_388637a98c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)