Advertisement|Remove ads.

Broadcom Bucks Broader Market Sell-Off As Chipmaker Announces $10B Stock Buyback: Retail Sentiment Lags Amid Tariff Mayhem

Shares of the world’s second-largest semiconductor manufacturer Broadcom, Inc. (AVGO) rallied on Tuesday, bucking the broader market and the tech sector sell-off.

The upside trigger was a capital allocation plan announced by the Palo Alto, California-based company.

Broadcom, which designs semiconductor and infrastructure software solutions, said its board has authorized a new share repurchase authorization to buy back up to $10 billion shares through the end of the year.

CEO Hock Tan said, "Today's announcement of a $10 billion share repurchase program reflects the Board's confidence in the strength of Broadcom's diversified semiconductor and infrastructure software product franchises.”

The executive said the company is uniquely positioned in mission critical infrastructure software and enabling hyperscalers to drive innovation in generative artificial intelligence (GenAI) into their expanding subscriber platforms.

CFO Kirsten Spears said the planned stock repurchase reflected the board's confidence in the company’s cash flow generation.

The new stock buyback plan comes amid Broadcom stock’s steep pullback due to the risk-off mood from President Donald Trump’s tariffs.

The stock is down over 38% from its all-time high of $251.88 reached on Dec. 16.

Broadcom has been having a good shareholder return policy. It announced a 10:1 stock split last year, which took effect on July 15. While announcing its fiscal year first-quarter results, it announced a quarterly dividend of $0.59, which was paid out on March 31.

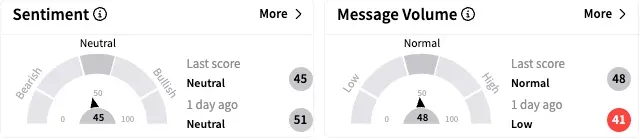

On Stocktwits, retail sentiment toward the stock stayed ‘neutral’ (45/100) and the message volume improved, although remaining ‘normal.’

A bullish user saw the stock buyback announcement as a harbinger of something good coming.

On the other hand, a bearish watcher shunned the buyback plan and said it was a ploy to buy back shares at depressed prices.

They noted that the $10 billion earmarked for repurchase represented 1%-2% of the outstanding shares and felt China’s response to U.S. tariffs will determine the near-term price trajectory of Broadcom stock.

A Stocktwits poll found that retail is not very excited about the stock. Only 9% said they would pick Broadcom among the chip stocks.

Broadcom ended Tuesday’s session up 1.23% at $156.03, compared to the 1.57% and 2.15% declines, respectively, by the S&P 500 and the Nasdaq Composite indices.

The Koyfin-compiled consensus price target for Broadcom stock is $246.39, implying about 60% upside from current levels.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)