Advertisement|Remove ads.

BSE Shares At Crucial ₹2,000 Level — What Should Investors Do Now?

BSE shares have been in a downtrend, falling 7% over the last five sessions. News reports suggest that the market regulator, Securities and Exchange Board of India (SEBI), has begun consultations on the future of weekly derivative contracts. Last month, SEBI Chairman Tuhin Kanta Pandey stated that the regulator was exploring options for longer-term derivative products.

This increased scrutiny in the derivatives market has been weighing on capital market stocks. In May this year, SEBI implemented a series of F&O (Futures and Options) tightening measures primarily to protect retail investors from excessive speculation and high-risk trading. These include revised position limits and tweaking the market wide position limit (MWPL) for single stocks. The weekly expiry days for BSE and NSE were also switched in August.

Rising F&O Scrutiny

SEBI-registered analyst Finkhoz RoboAdvisory highlighted that BSE’s business has grown, with sales going from ₹193 crore in June 2022 to ₹958 crore in June 2025. Net profit has also increased, reaching ₹538 crore in the latest quarter, representing a significant improvement compared to the previous few quarters. Additionally, the profit margins have been strong. As of June 2025, BSE shows an operating margin of 65%, indicating that even after the rule changes, it is running its business efficiently.

However, the analyst cautioned that these changing SEBI rules and shifting expiry days are making it harder for short-term traders and could hurt BSE’s revenue from its star F&O segment. Earnings may drop 25–38% if volumes fall badly, they added.

Technical Outlook

On the technical charts, BSE’s weekly chart shows a big rally from ₹660 up to almost ₹3,000 in 18 months, before falling back to ₹2,076. Finkhoz noted that since the implementation of SEBI’s new rules, the price has dipped, and weekly candles are red, showing sellers have taken control for now.

Its Relative Strength Index (RSI) is near 45, below the midpoint, indicating that profit booking and caution are setting in after a prolonged uptrend.

Finkhoz identified support around ₹2,000 (close to the 50-week moving average), adding that if this level holds, buyers may return slowly. However, if BSE stock breaks below this level, selling pressure could intensify.

What Should Investors Do?

Finkhoz concluded that BSE’s numbers are still solid, and the company has a good base, but growth from F&O might slow down unless they find new ways to boost business.

Since the stock has seen a significant run-up, smart money is now pausing to watch how earnings respond to SEBI’s tough rules before getting back in. For new investors, they advised waiting for clear signs of stability or new earnings leadership rather than chasing every dip.

What Is The Retail Mood?

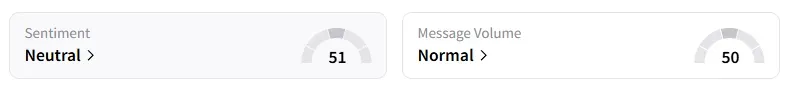

Data on Stocktwits shows that retail sentiment has been ‘neutral’ for a week. It was ‘bullish’ a month ago.

BSE shares have seen a 26% fall in the last three months.

Stocktwits’ Yash Upadhyay breaks down the reasons behind its selloff! Watch the video here to discover analysis and views from SEBI-registered advisors.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)