Advertisement|Remove ads.

BSE Shares Slide Below Key Averages: SEBI RA Sudhansu Panda Warns Of Breakdown Risk Near ₹2,370

BSE has been in a corrective phase after touching a high near ₹3,000. In the past month, the stock has declined nearly 10%.

BSE shares are currently trading below their key moving averages, the 50-day exponential moving average (EMA) at ₹2,523 and the 20-day EMA at ₹2,554, indicating persistent bearish pressure, said Sudhansu Sekhar Panda of Bluemoon Research.

On the daily chart, an inverted flag and pole pattern has emerged, the analyst observed. It typically serves as a continuation signal in a downtrend, indicating the potential for further downside unless a strong bullish trigger emerges.

The price has been moving in a volatile, sideways range of ₹2,370 - ₹2,580 over the past two weeks, with the ₹2,370 - ₹2,400 zone acting as critical support. A breakdown below this could drag the stock toward ₹2,300 - ₹2,230, with ultimate support seen around ₹2,030, based on past resistance-turned-support dynamics, Panda said.

At the time of writing, the stock is up 1.1% at ₹2,491.30.

However, with the shares down nearly 18% from their recent peak, investors can consider buying, according to Panda. A close above ₹2,580, without breaching the ₹2370 - ₹2400 support zone, could offer a potential upside toward ₹2,650 - ₹2,700, with ₹2,500 as a new support base.

For long-term investors, any deeper correction into the ₹2,050 - ₹2,200 zone could be an enticing accumulation range, considering BSE’s strong fundamentals.

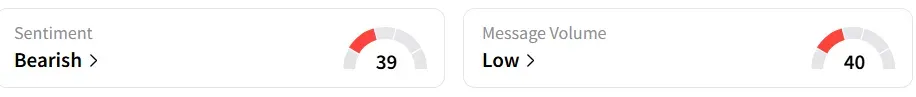

Retail sentiment shifted to ‘bearish’ from ‘neutral’ a day earlier.

Year-to-date (YTD), the stock has surged 40.5%

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228736233_jpg_f3ebe80a4c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)