Advertisement|Remove ads.

Bumble Stock Tumbles Premarket On Weak Q4 User Metrics, Subpar Q1 Guidance: Retail Spurns Dating Platform

Dating and social networking platform Bumble, Inc’s (BMBL) shares fell sharply in Wednesday’s premarket session after the company reported slower user growth and a disappointing first-quarter revenue guidance.

The Austin, Texas-based company reported fourth-quarter adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA) of $72.5 million, down from $73.7 million in the year-ago quarter but in line with the guidance of $70 million to $73 million

The adjusted EBITDA margin expanded to 27.7% from $26.9%.

Operating earnings improved year-over-year (YoY) to $37 million from $6.9 million.

Bumble’s fourth-quarter revenue fell 4.4% YoY to $261.6 million, ahead of the consensus estimate of $260.54 million as seen on Yahoo Finance. The topline aligned with the guidance range of $256 million to $262 million.

Bumble App revenue fell 3.8% to $212.4 million versus the guidance of $207 million to $211 million, and Badoo App and other revenue declined 6.8% to $49.3 million.

Among user metrics, total paying users rose 5.3% to 4.2 million, slower than the 13% growth in the third quarter. Total average revenue per paying user (ARPPU) declined to $20.58 from last year’s $22.64.

CFO Anu Subramanian said, “We achieved our fourth quarter financial objectives, while outperforming our outlook for Bumble app, by advancing our strategic objectives with discipline and focus.”

Bumble guided to first-quarter revenue of $242 million to $248 million, including $198 million to $202 million in Bumble App revenue. Analysts, on average, expect revenue of $252.05 million.

The company expects adjusted EBITDA of $60 million to $63 million.

Bumble CEO Lidiane Jones said the company is well positioned to “boldly reimagine the future of online dating while creating meaningful and kind connections in service of our mission,” given its product roadmap for the year ahead and the founder's return to the helm.

In mid-January, the company said founder Whitney Wolfe Herd would return as CEO in March as the dating services platform struggles to gain traction.

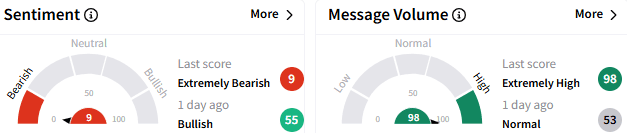

On Stocktwits, sentiment toward Bumble stock fell to ‘extremely bearish’ (9/100) from the ‘bullish’ mood that prevailed a day ago. The message volume perked to an ‘extremely high’ level. It was among the top ten trending tickers on the platform

A watcher said the stock could experience a big decline at the open.

Bumble shares have lost a modest 0.5% this year after losing 45% in 2024.

In premarket trading, Bumble stock plunged 16.79% to $6.74, headed toward the lowest since mid-October. The premarket pullback marked the steepest since the 29%+ drop in early August when the company cut its 2024 sales forecast.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_chart_rising_resized_6ebc3dd7e4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ethereum_ishares_OG_jpg_61ef2b2562.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_capricor_jpg_9f4f8ab098.webp)