Advertisement|Remove ads.

BurgerFi Stock Slides On Chapter 11 Bankruptcy Filing: Retail Sentiment Sours

U.S. burger chain BurgerFi International Inc (BFI) has filed for Chapter 11 bankruptcy protection in Delaware, and listed $50 million to $100 million in assets and $100 million to $500 million in debt, according to a Bloomberg report. Shares of the firm fell over 19% on Wednesday following the report.

The company, which owns Anthony’s Coal Fired Pizza & Wings, had recently received deficiency notices from Nasdaq related to its failure to timely file its quarterly report on Form 10-Q for the quarter ended July 1, 2024 as well as the composition of Board committees arising from the resignation of directors.

In July, the company entered into an agreement with Lion Point Capital to resolve all claims between the two parties. The firm agreed to pay Lion Point $1.35 million in installments as well as issue 300,000 shares of Series A preferred stock.

Earlier, BurgerFi had entered into a forbearance agreement and seventeenth amendment to its existing credit facilities with TREW Capital Management.

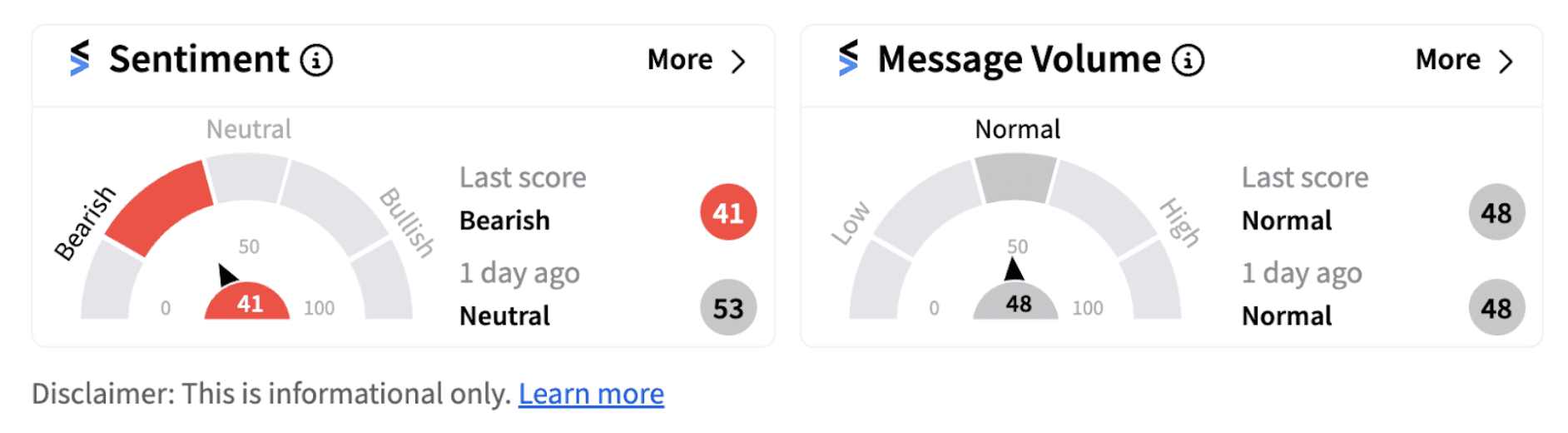

Following the disclosure, retail sentiment on Stocktwits dipped into the ‘bearish’ territory (41/100) from the ‘neutral’ zone.

Shares of the firm have lost over 81% since the beginning of the year, with the bulk of the losses recorded only over the last month. Investor confidence eroded after BurgerFi said in August it may seek protection if it does not receive adequate relief from its senior lender and additional sufficient liquidity from potential liquidity providers or from sales of the company’s assets to meet its current obligations.

BurgerFi also said it expects to report a significantly higher net loss of $18.40 million for the quarter ended July 1, 2024, as compared to a net loss of $6.00 million for the quarter ended July 3, 2023. Net loss increased primarily due to lower operating income, higher general and administrative expenses, and higher restructuring costs, it said.

BurgerFi joins a list of restaurants that filed for bankruptcy this year as high inflation limited consumer spending. At least 10 restaurant chains have reportedly filed for bankruptcy protection this year including Red Lobster, Buca di Beppo and Roti.

Several Stocktwits users are concerned following the report, with one user believing there’s no use holding the stock.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_supermicro_resized_jpg_95d12828d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_UWM_resized_f22f7e06b8.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)