Advertisement|Remove ads.

Torrent Power: SEBI RA Deepak Pal Sees Bullish Momentum, Sets Target At ₹1,530

Torrent Power has staged a significant recovery over the past 10 days, with the stock now trading above key moving averages.

The stock began a steady upward reversal after hitting a bottom of ₹1,358.00 on June 19 and ₹1,360.00 on June 20, noted SEBI-registered analyst Deepak Pal.

Torrent Power is currently trading above its 14-day, 55-day, and 200-day exponential moving averages (EMA), signaling a growing bullish sentiment.

On Monday, the stock opened at ₹1,469.90, dipped to a low of ₹1,438.00, and is trading at ₹1,458 at the time of writing.

The bullish strength is further supported by technical indicators, such as the relative strength index (RSI) and moving average convergence/divergence (MACD), as well as rising trading volumes, Pal added.

Fundamentally and technically, the stock appears well-positioned for further upside. Investors could consider buying in the dips at the ₹1,440 - ₹1,450 range for medium-term gains, he said, recommending a stoploss at ₹1,400.

A near-term price target of ₹1,525 - ₹1,530 is possible if the current momentum continues, Pal stated. It represents a near 5% upside over the current stock price.

The company reported an annual net profit of ₹3,059 crore on revenue of ₹29,165 crore, delivering continued growth across its gas-based and distribution segments, the analyst noted.

Torrent Power, which engages in the business of power generation, transmission, and distribution of electricity, recently received a green light from the Maharashtra Electricity Regulatory Commission (MERC) to offer parallel power distribution services in Pune, Nagpur and the Mumbai Metropolitan Region (MMR).

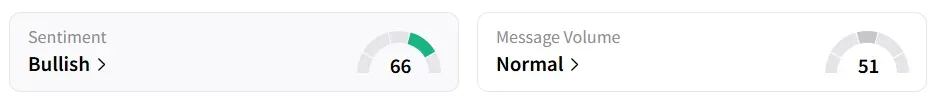

Retail sentiment on Stocktwits remained ‘bullish’

Year-to-date (YTD), the stock shed 1.7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)