Advertisement|Remove ads.

Caesars Stock Surges After 2 Icahn Executives Join As Independent Directors: Retail Sentiment Stays Upbeat

Shares of Caesars Entertainment Inc. (CZR) rose nearly 2% in after-hours trading on Tuesday after the casino operator announced the addition of two new board members, both of Icahn Enterprises, with retail sentiment staying bullish.

The company named Jesse Lynn, general counsel of Icahn Enterprises, and Ted Papapostolou, CFO at Icahn to its board.

“We look forward to working with Tom and the board to maximize value for all shareholders, including by exploring strategic alternatives for the company’s underappreciated digital business,” said Carl C. Icahn, chairman of Icahn Enterprises.

Tom Reeg, CEO of Caesars, said both bring “diverse and relevant experience that will assist the board in maximizing value for all shareholders.” With the additions, Caesars’ board will expand to 12 directors.

Caesars, which owns resorts such as Harrah’s, Caesars, and Eldorado, posted $2.8 billion in revenue for its fourth quarter, missing estimates. However, its earnings per share came in at $0.05, beating Wall Street estimates.

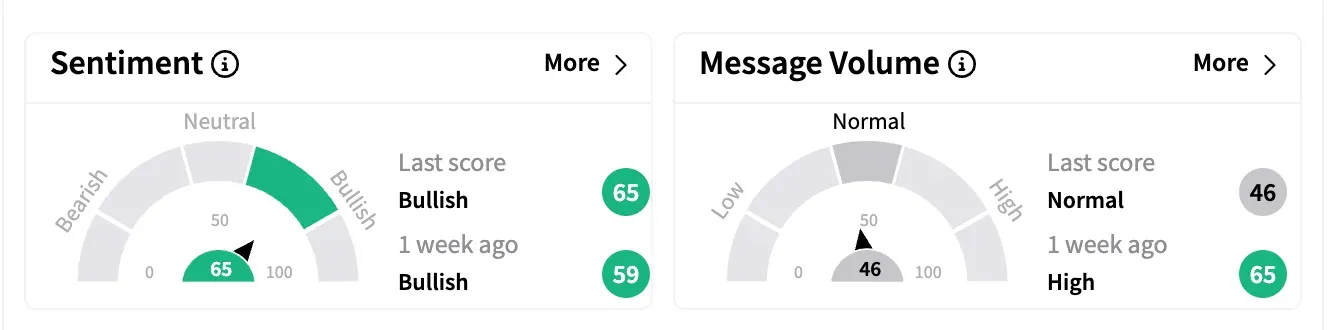

Sentiment on Stocktwits inched up in the bullish zone. Message volume was in the normal zone compared to high a week ago.

Jefferies analyst David Katz Caesars said the addition of Icahn execs is not surprising but is incrementally 'positive' for shares, the Fly reported.

Jefferies has a ‘Buy’ rating and a $50 price target on the shares, added the report. According to the firm, “there is potential value upside in the digital business once its earnings power is established” similar to its other business segments.

Caesars stock is down 17.5% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254648547_jpg_a843db78b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1000648682_jpg_6aa61e3574.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259602028_jpg_5b1a490e64.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259775985_jpg_a06a1e88c3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dogecoin_OG_2_jpg_304df31f25.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_vitalik_buterin_OG_jpg_7ac8ea93fe.webp)