Advertisement|Remove ads.

Cameco, Brookfield Team With US Government For $80B Nuclear Reactor Drive

- Cameco and Brookfield Asset Management formed a strategic partnership with the U.S. Department of Commerce to expand Westinghouse’s nuclear reactor deployment.

- The U.S. government plans to facilitate financing and approvals for new reactors, representing an investment of $80 billion.

- Cameco shares surged over 14% in premarket trading, as investor sentiment turned bullish on the company’s nuclear growth prospects.

Cameco Corp. (CCJ) announced on Tuesday that it has entered into a binding term sheet with Brookfield Asset Management and the U.S. Department of Commerce to create a strategic partnership aimed at expanding the deployment of Westinghouse Electric Company’s nuclear reactor technologies.

The collaboration seeks to boost nuclear power generation capacity in the United States and strengthen the global nuclear supply chain.

Details Of The Agreement

The partnership outlines plans for the U.S. government to support financing and facilitate approvals for the construction of new Westinghouse reactors within the country.

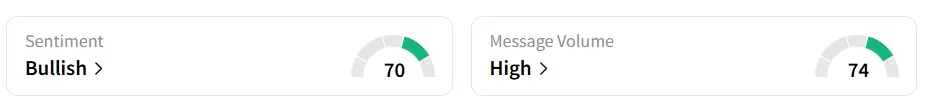

Cameco stock traded over 14% higher in Tuesday’s premarket. On Stocktwits, retail sentiment around the stock jumped to ‘bullish’ from ‘bearish’ territory the previous day. Message volume improved to ‘high’ from ‘low’ levels in 24 hours.

The total investment is estimated at approximately $80 billion, which includes near-term funding for equipment with extended production timelines.

Revitalizing Nuclear Infrastructure

Once operational, these reactors are expected to deliver secure, stable power to the American grid and to supply energy for data centers and artificial intelligence infrastructure.

“This new partnership highlights the role that Westinghouse’s reactor technologies, based on fully designed, licensed and operating reactors, are expected to play in the planned expansion of nuclear capacity and diversification of global nuclear supply chains.”

–Tim Gitzel, CEO, Cameco.

The U.S. government will obtain a ‘Participation Interest’ that, once vested, gives it a 20% share of any cash distributions above $17.5 billion from Westinghouse. Cameco and Brookfield acquired Westinghouse in November 2023.

Cameco stock has gained over 68% year-to-date and 57% in the last 12 months.

Also See:TeraWulf Stock Just Shot Up 8% Today: Why Is Fluidstack Partnership Drawing Investor Attention?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Block_Inc_logo_displayed_on_smartphone_screen_6065fd32bb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_robotaxi_jpg_ade25faaed.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Robotaxi_Tesla_jpg_209f017098.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)