Advertisement|Remove ads.

Camtek Shares Jump Premarket As HPC Demand Drives Earnings Beat: Retail's Overjoyed

Camtek Ltd. ($CAMT) surged as much as 11% in pre-market trading Tuesday after reporting stronger-than-expected third-quarter earnings, lifted by continued demand in high-performance computing (HPC) sectors.

The Israel-based company, specializing in semiconductor inspection and metrology equipment, posted earnings of $0.75 per share, topping Wall Street estimates of $0.69.

Revenue came in at $112.3 million, beating the consensus forecast of $108.51 million and marking a 40% increase year-over-year.

Looking ahead, Camtek expects fourth-quarter revenue to come in around $115 million, representing an anticipated 30% annual growth, largely due to the robust HPC market.

“We expect the overall contribution of HPC to our business this year to be around 50% and foresee it as a major growth driver in 2025,” said CEO Rafi Amit, adding that demand is also rising in other segments.

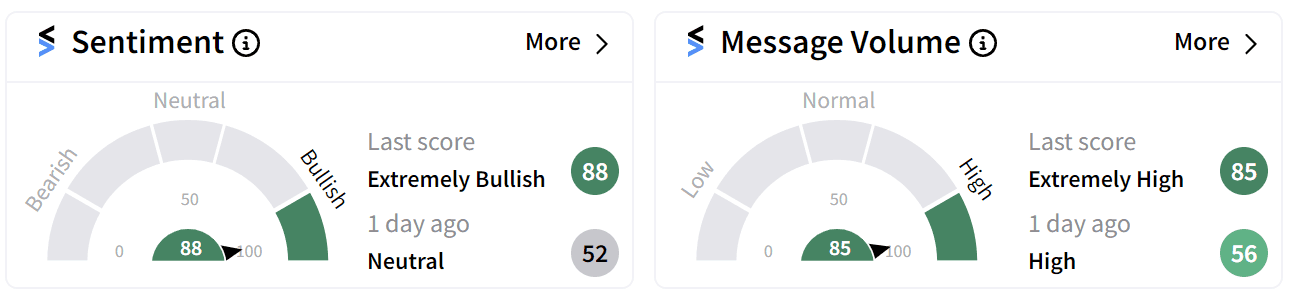

Retail sentiment surged to ‘extremely bullish’ (88/100) on Stocktwits ahead of the company’s earnings, bolstered by ‘extremely high’ (85/100) chatter.

Last week, Camtek announced it has received $20 million in orders for its new Eagle G5 system, designed for 2D inspection in advanced packaging fan-out applications.

According to the company, the G5 stands out for its high-speed processing, precision, and adaptability to advanced semiconductor manufacturing needs. It is expected to lead a series of new product introductions from Camtek in the coming months.

Camtek’s stock has risen 23% this year so far.

It hit an all-time high of $140.5 in July on news of securing a new $20 million order from a top-tier Outsourced Semiconductor Assembly and Test (OSAT) provider and repeat orders in excess of $2.5 million for its Xact200 system from a “number of leading semiconductor manufacturers.”

For updates and corrections email newsroom@stocktwits.com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump2_jpg_ad63f384b5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1247400381_jpg_765e6ec016.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_GE_Aerospace_resized_1_jpg_03f4fd7e4e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)