Advertisement|Remove ads.

Nvidia Stock Dips As Monolithic Power Crashes On Concerns of Supplier Allocation For Blackwell AI Chips: Retail Focuses On Earnings

Shares of Nvidia Corp. ($NVDA) fell by more than 1% on Monday following a report by Edgewater Research suggesting that performance problems with Monolithic Power's ($MPWR) components could reduce or even eliminate the company's role in Nvidia's next-generation Blackwell processors.

As a result, Monolithic Power’s stock dropped sharply by over 20%.

The report claimed that while Nvidia will honor existing orders, it has canceled much of Monolithic's future business and redirected orders to other suppliers, Renesas Electronics Corp. ($RNECY) and Infineon Technologies AG ($IFNNY).

"We hear NVDA will go through their confirmed orders to MPWR for the next few quarters, but we hear NVDA has canceled half of MPWR's backlog, cutting all of their unconfirmed orders," the report said.

Both companies saw their stock prices rise by over 3% in mid-day trading on Monday.

Issues with Monolithic Power’s voltage regulator module and power management IC "appear likely to severely limit or eliminate" the company’s role in the production of Nvidia’s Blackwell chips, according to Edgewater Research.

Renesas and Infineon are set to take over key components for Nvidia's upcoming chips, with Renesas stepping in for the B200 allocation and Infineon handling the GB200 allocation.

Both companies have received urgent orders in recent weeks, according to Edgewater’s report.

Despite these concerns, Deutsche Bank remains skeptical that Monolithic will lose all of its Nvidia business.

The brokerage argues that the strong relationship and incumbent position Monolithic holds with Nvidia makes it unlikely that the performance issues are as severe as reported.

However, if the claims prove accurate, Monolithic could see up to 15% of its revenue at risk.

Deutsche Bank has maintained its ‘Buy’ rating on Monolithic Power’s stock with a price target of $900.

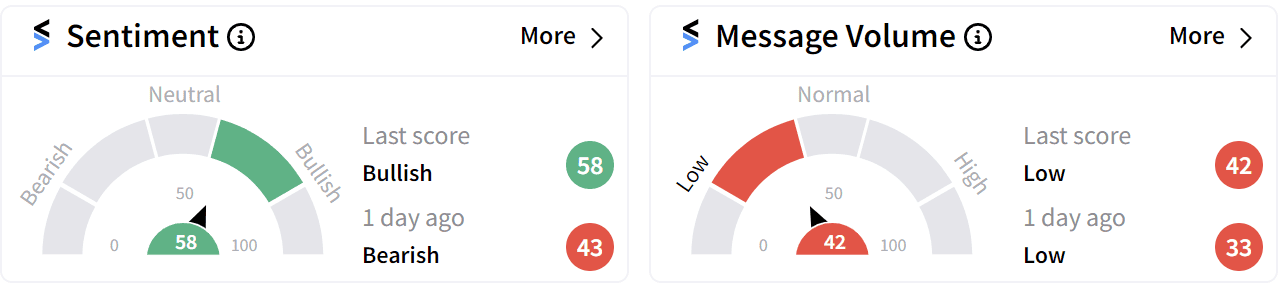

Retail sentiment around Nvidia has flipped to ‘bullish’ (58/100) despite the dip in stock value.

Nvidia’s stock hit a new all-time high on Friday after joining the Dow Jones Industrial Average ($DJIA).

As Nvidia gears up to report its third-quarter results on Nov. 20, analysts are largely optimistic. Wall Street expects earnings of $0.74 per share on $32.96 billion in revenue, according to Stocktwits data.

Morgan Stanley raised its price target on Nvidia to $160 from $150, maintaining an ‘Overweight’ rating on Monday.

While the brokerage anticipates a strong quarterly showing, it suggests the bigger upgrades may come later, as Nvidia’s supply remains tight for Blackwell and partly for H200 processors.

Piper Sandler also lifted its price target, going from $140 to $175, citing Nvidia’s “dominant positioning” in AI accelerators and the anticipated Blackwell launch.

With Nvidia’s stock already up over 200% this year, investors will be closely watching the company's Q3 performance and outlook, especially given its strategic moves in AI and chip technology.

For updates and corrections email newsroom@stocktwits.com.

Read more: NVIDIA Stock Rallies To Record High After Dow Entry, Retail Sentiment Cools From Peak Levels

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elizabeth_warren_original_2_jpg_bd4f84b387.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212700544_jpg_8378e13131.webp)