Advertisement|Remove ads.

Canara Bank Charts Signal Trend Reversal, Say SEBI Analysts

Canara Bank shares have risen over 2% on Wednesday, tracking gains in the broader PSU bank sector.

Analyst Priyank Sharma highlighted the clean price action on its technical charts, indicating market manipulation, reversal, and the continuation of a strong trend emerging from the bottom. He added that liquidity was taken out below equal lows recently, which was then followed by a decisive shift in market structure toward the upside.

Earlier in the week, analyst Deepak Pal had flagged that Canara Bank stock appeared to be in a neutral to slightly bullish phase on the daily chart. Its Relative Strength Index (RSI) stands around 60, indicating moderate strength without overbought conditions. He added that overall technical indicators lean toward a neutral buy rating.

In the short term, Pal expects Canara Bank to trade with caution and range-bound movement. It needs a clear breakout above near-term resistance or a retention above recent support to trigger a further upside. He advised short-term traders to watch for consolidation and look for potential buying opportunities around support levels.

Over the medium-to-long term, he added that strong fundamentals are visible in earnings. The bank also expanded its rural footprint by sponsoring the newly formed Karnataka Grameena Bank, boosting regional presence post-RRB consolidation.

For catalysts going ahead, he advised investors to monitor the corporate loan pipeline (₹50,000–55,000 cr), rate movements on fixed deposits and MCLR, and its upcoming earnings report by the end of October.

What Is The Retail Mood?

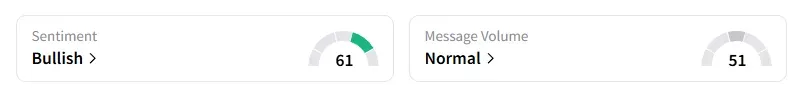

Data on Stocktwits shows retail sentiment turned ‘bullish’ a day ago.

Canara Bank shares have risen 11% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)