Advertisement|Remove ads.

Capri's Versace Deal With Prada Could Reportedly Drop This Week: Retail Investors Eye Upside

Capri Holdings Ltd (CPRI) could be close to signing a deal to sell its luxury fashion label Versace to Prada, Reuters reported on Sunday.

The Italian fashion group could announce the Versase deal as soon as Thursday at a price of 1 billion euros ($1.1 billion), the news agency reported, citing a source and Italian newspapers.

Capri CEO John Idol is expected to be in Milan in the coming days to discuss the deal.

The Prada-Versace deal talks have been doing rounds in recent months. In February, reports said Prada was given four weeks to assess its smaller rival's financials and viability for the deal.

It was also reported that Prada could be interested in buying Jimmy Choo, another Capri brand. Last month, Prada CEO Andrea Guerra was reportedly in New York to discuss the deal.

This is not the first time Capri is looking at a divestiture.

The company earlier agreed to sell Versace, Michael Kors, and Jimmy Choo to Tapestry, Inc. (TPR) for $8.5 billion.

However, after nearly a year and a half of pursuing the deal with regulators—the Federal Trade Commission (FTC) had blocked the bid on antitrust grounds—the two sides terminated the agreement in November last year.

Capri acquired Verchase for 1.8 billion euros in 2018.

If the deal goes through, Capri would have offloaded a loss-making asset and gained much-needed cash to pare its debt. S&P Global Ratings recently downgraded the company credit rating to junk, citing weak performance and elevated leverage.

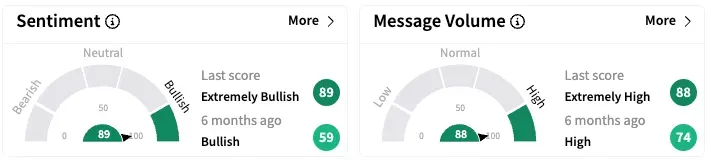

On Stocktwits, retail sentiment for Capri jumped to 'extremely bullish' from 'bearish' a week ago, and message volume jumped to 'extremely high'.

"It's still a coin toss," said one user, adding that the weak stock price makes for an attractive opportunity.

Another user said that if the Versace deal falls through, Capri risks going bankrupt.

Capri shares closed at $14.52 on Friday, down 31.1% year to date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)