Advertisement|Remove ads.

Cava's Retail Investors Remain Extremely Bullish After Analyst's Upgrade Citing Brighter Future For Fast-Casual Dining

Shares of CAVA Group Inc. (CAVA) ended Friday over 5% higher after the Mediterranean fast-casual restaurant chain received an upgrade following its fourth-quarter earnings, with retail sentiment staying optimistic.

The Fly reported that Piper Sandler analyst Brian Mullan upgraded Cava to 'Overweight' from 'Neutral' with a price target of $115, down from $142.

According to the firm, the fast-casual food sector is seeing "secular growth" and saw CAVA as one of the best ways to cash in on the trend.

The analyst reportedly said the recent sell-off in Cava shares amid a "choppy" environment also reflected an opportunity.

However, Bernstein analyst Danilo Gargiulo lowered the firm's price target to $115 from $145 with a 'Market Perform' rating, The Fly reported.

According to the firm, the company's front-loaded same-store sales guidance makes it likely to beat the guidance, leading to an appreciation in the stock amid improving trends.

The report added that the higher new store productivity also supports Cava's business model's durability and scaling opportunity, which is necessary for a higher stock valuation.

Bernstein warned that investors seeking margin increases in the medium term may be disappointed, given Cava is expected to "manage its P&L."

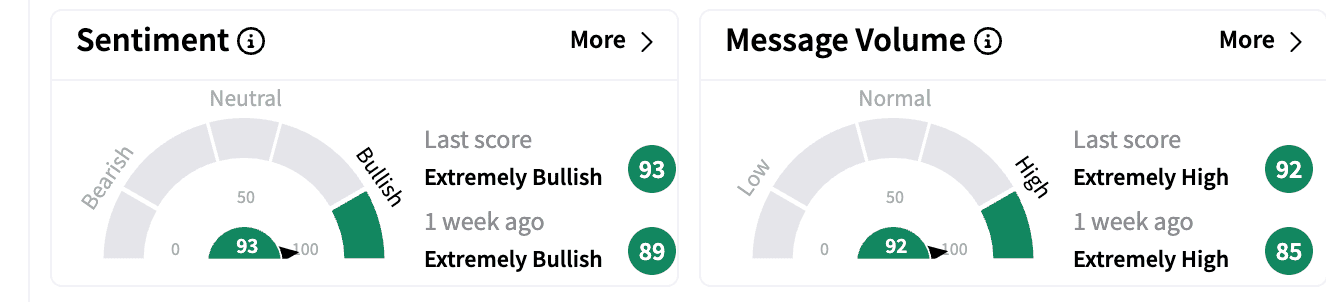

Sentiment on Stocktwits remained 'extremely bullish' on Friday compared to a week ago. Message volume remained in the 'extremely high' zone.

For 2025, Cava projected similar restaurant sales growth as last year, between 6% and 8%.

For Q4, Cava's earnings per share came in at $0.05, missing estimates of $0.07. Its revenue grew 28.3% to $225.1 million in the prior year quarter, with same-restaurant sales growth of 21.2%.

Seventy-seven new restaurant openings drove the increase in Cava's revenue during or after the fiscal fourth quarter of 2023.

Cava stock is down more than 16% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262161352_jpg_832967dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)