Advertisement|Remove ads.

Celsius CFO Warns of Q4 ‘Noise’ Amid Alani Nu Pepsi Rollout, But Retail Goes Contrarian

- In the Q3 earnings call, CFO Jarrod Langhans mentioned that additional costs, including freight and tariffs, could impact margins.

- Starting in December, Alani Nu will begin its phased rollout across the PepsiCo distribution network in the U.S.

- Alani Nu’s brand retail sales increased 114% YoY in Q3, and the CELSIUS brand’s sales gained 13% YoY.

Celsius Holdings, Inc. (CELH) Chief Financial Officer, Jarrod Langhans, anticipates that the fourth quarter will reflect ‘noise’ due to year-end promotional timing, integration processes, and cash management by large clients.

In the third-quarter (Q3) earnings call, he added that additional costs, including freight and tariffs, could also impact margins.

For Q3, the company reported revenue of $725.1 million, representing a 173% year-over-year (YoY) growth. Adjusted earnings per share (EPS) were $0.42. Both the revenue and adjusted EPS surpassed the analysts’ consensus estimate of $715.70 million and $0.27, respectively, according to Fiscal AI data.

Strategic Distribution Rollout

Starting in December, Alani Nu will begin its phased rollout across the PepsiCo distribution network in the U.S., said Langhans. In July, Celsius had agreed to acquire the energy drink brand Alani Nutrition LLC for $1.8 billion.

“As Alani begins distribution in the U.S. Pepsi system in December, most of the financial benefit is expected to be realized in Q1 2026 due to a phase load-in approach ramping from Q4 into Q1 as retailers reset and inventory builds across the Pepsi network.”

-Jarrod Langhans, CFO, Celsius.

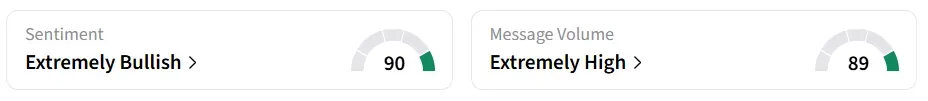

Celsius’ stock traded 23% lower by mid-morning on Thursday and was the top-trending equity ticker on Stocktwits. Retail sentiment around the stock jumped to ‘extremely bullish’ from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ from ‘normal’ levels in 24 hours.

A bullish Stocktwits user expressed optimism about the Pepsi partnership.

Another user called the stock’s fall an ‘extreme overreaction’.

Alani Nu Distribution Costs

The transition of Alani Nu into PepsiCo’s distribution system in the U.S. and Canada involved $246.7 million in distributor termination costs, the company stated. PepsiCo will fund these termination fees, resulting in a neutral cash impact for Celsius.

Alani Nu’s brand retail sales increased 114% YoY in Q3, CELSIUS brand’s sales gained 13% and Rockstar Energy’s sales fell 9% YoY.

Celsius’ stock has gained over 73% year-to-date and over 52% in the last 12 months.

Also See: DDOG Stock Surged 22% Today: What’s Powering The Rally?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_vertex_logo_resized_4070318817.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_shell_resized_jpg_161ef0a394.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Emirates_jpg_2620b94b3d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_jpg_dcfe443bb4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_Siri_jpg_30dce91b4f.webp)