Advertisement|Remove ads.

Celsius Holdings Stock Soars On $1.8B Alani Nu Acquisition, Q4 Earnings Beat: Retail’s Exuberant

Shares of Celsius Holdings Inc. (CELH) soared nearly 36% in after-hours trading Thursday after the energy drinks maker reported a quarterly earnings beat and agreed to acquire Alani Nutrition LLC for $1.8 billion, lifting retail sentiment.

The transaction, which includes a mix of cash and stock including a potential $25 million earn-out, will combine “two growing, scaled brands in the U.S. energy drink category,” Celsius said in a statement. The transaction is expected to close in the second quarter of 2025.

Founded in 2018, Alani Nu is a growing, female-focused brand that combined with Celsius, is expected to drive about $2 billion in sales.

Separately, Celsius Holdings also reported better-than-expected earnings for its fourth quarter.

"Our record $1.36 billion full-year 2024 revenue reflects a solid year of performance, underscored by consumers' continued preference for our great-tasting, functional products. Celsius achieved exceptional milestones in 2024, which included contributing 30% of all category growth and increasing our category share by 160 basis points to 11.8%,” said John Fieldly, chairman and CEO of Celsius Holdings.

Celsius’s Q4 adjusted earnings per share came in at $0.14, surpassing consensus estimates of $0.10, while Q4 revenue stood at $332.2 million, beating expectations of $326.19 million.

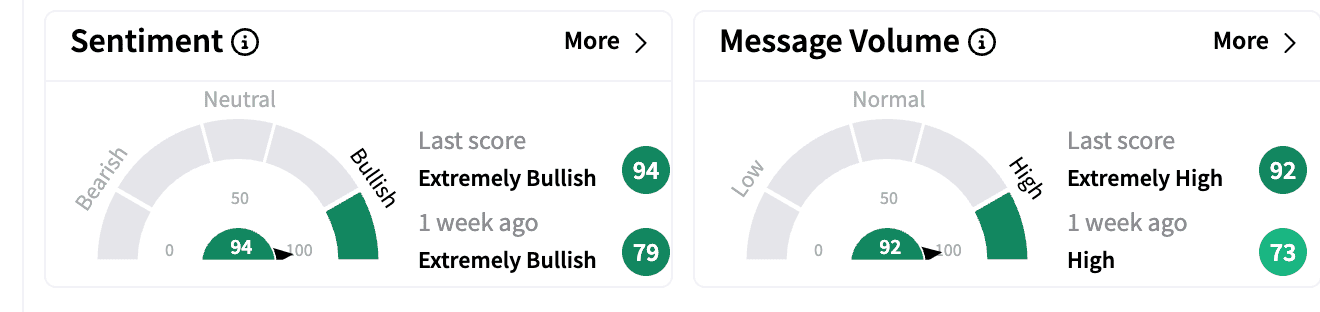

Sentiment on Stocktwits inched up in the ‘extremely bullish’ zone with commenters cheering the earnings and the deal. Message volumes jumped to the ‘extremely high’ zone.

One bullish commenter expects Celsius stock to reach $70 on Friday.

The acquisition of Alani Nu will further strengthen Celsius' position in the “large, growing global energy category” which is projected to grow at a compounded annual growth rate of 10% from 2024 to 2029, the company noted.

It is expected to boost cash EPS in the first year, with projected run-rate cost synergies of $50 million within two years.

Retail sales of Alani Nu increased by 78% year-over-year as reported by Circana for the last-four-week period ended Jan. 26, 2025, the company noted.

The purchase price for Alani Nu consists of $1.27 billion of cash and a $25 million earn-out and $500 million of newly issued restricted shares of Celsius Holdings common stock, representing about 8.7% pro-forma ownership.

The cash payment consists of debt financing of $900 million and about $375 million of cash on hand, according to Celsius.

Celsius stock is down 3% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Circle_Internet_jpg_add0182c9c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263898051_jpg_9e75888009.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1227710498_jpg_fbb12d04bf.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)