Advertisement|Remove ads.

Celsius Ignites Retail Trader Frenzy After Stock Surges 17% On Blowout Q2 Earnings Powered By Alani Buy

Celsius Holdings (CELH) drew heavy online chatter from retail investors and fans late Thursday, after the stock surged over 17% to an over 12-month high following blowout quarterly results.

The energy and wellness drinks company said second-quarter revenue rose 84% to $739.3 million, beating analysts' estimate of $655.7 million. Adjusted profit rose 68% to $0.47 per share, nearly double the expectation of $0.25.

The results were boosted by Alani Nutrition, a rival company Celsius acquired in April, and operational efficiencies across the business, CEO John Fieldly said in a statement.

Celsius also continued to gain market share, achieving a 17.3% dollar share of the U.S. ready-to-drink (RTD) energy category for the second quarter, representing a 180-basis-point increase from the prior quarter, Fieldly said on the post-earnings call.

Meanwhile, the Alani brand's dollar sales surged 129% year-over-year and market share rose by 3.2 percentage points to 6.3%, making it the largest share gainer in the RTD energy space during the period.

Fieldly also revealed that Celsius Holdings' portfolio surpassed $4 billion in retail sales across tracked channels for the 52 weeks ending July 20, 2025.

"That's more than the next 8 RTD energy brands combined in the same period, a clear signal of the category momentum we're leading and the demand our brands have generated," he said.

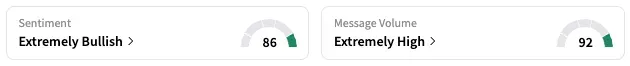

On Stocktwits, the retail sentiment shifted to 'extremely bullish' late Thursday from 'bullish' two days back, and message volume of the past 24 hours rose over 250%.

"Impressed [with] $CELH nice comeback !!" a user wrote, with another expecting "fat a** upgrades" from analysts in the coming days.

Energy and wellness drinks have become a key focus area in the packaged food space, as consumers seek healthier options.

Celsius paid $1.8 billion in cash and stock for Alani Nutrition. Late last year, Keurig Dr Pepper (KDP) acquired a 60% stake in energy drink maker Ghost for $990 million.

Including Thursday's move, Celsius shares are up 90% year-to-date, compared to the 7.8% gains in the benchmark S&P 500 index (SPX).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Read Next: Instagram's Map Feature Has People Screaming Privacy Nightmare — Should You Be Worried?

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)