Advertisement|Remove ads.

Centene Reports Upbeat Q1 Earnings But Higher Medicaid Costs Drag Stock: Retail Turns Bullish

Shares of Centene Corporation (CNC) declined 7% on Friday, despite the company's first-quarter earnings topping Wall Street estimates, as it reported a rise in medical costs.

The company reported a health benefits ratio (HBR) of 87.5% for the quarter, up from 87.1% in the comparable period of 2024. The metric compares a health insurer's healthcare-related costs to its premium revenue.

The increase in HBR was primarily driven by a higher Medicaid HBR due to influenza-and-like illnesses, the company said. The first-quarter HBR in its Medicaid business came in at 93.6%, up from 90.9% in the corresponding period of 2024.

The company now expects HBR for the full year in the range of 88.9% to 89.5%, up from its previous guidance of 88.4% to 89%.

The firm reported an adjusted diluted earnings per share (EPS) of $2.90, up from $2.26 in the corresponding quarter of the previous year, and above an analyst estimate of $2.52, according to FinChat data.

Revenue for the three months through the end of March came in at $46.62 billion, up from $40.41 billion in the corresponding quarter of 2024, and above an estimated $43.25 billion.

The company’s total medicaid memberships fell 2.5% to 12.96 million in the quarter, while total commercial memberships jumped 27% to 6.07 million.

Medical costs in the quarter came in at $36.5 billion, up from $30.93 billion in the prior-year period.

Centene increased its 2025 health insurance premium and service revenues guidance range by $6 billion to a range of $164 billion to $166 billion.

The insurer stated that its new forecast reflects expectations of $5 billion in additional individual marketplace premium revenue due to outperformance in enrollment throughout the first quarter, as well as $1 billion in additional premium revenue from Medicare member retention.

The company’s premium and services revenue increased 17% to $42.49 billion during the first quarter.

For the full year, the company expects adjusted EPS greater than $7.25 and revenue in the range of $178.5 billion to $181.5 billion.

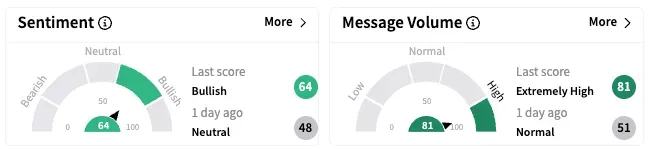

On Stocktwits, retail sentiment around Centene rose from ‘neutral’ to ‘bullish’ over the past 24 hours while message volume jumped from ‘normal’ to ‘extremely high’ levels.

CNC stock is down by about 5% so far this year and by about 24% over the past 12 months.

Also See: HCA Healthcare Reports Upbeat Q1 Earnings, Reaffirms 2025 Guidance: Retail Stays Optimistic

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229886652_jpg_a4903ce2cc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_resized3_jpg_d9e74e2821.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/tesla_cybercab_display_resized_jpg_c5beeba25b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250241035_jpg_937df85f43.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Applied_Digital_jpg_95c1bba239.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_generic_resized_jpg_3444b70edf.webp)