Advertisement|Remove ads.

CENX, KALU: US Aluminum Stocks Rip After Trump Doubles Tariffs On Imports

U.S.-focused aluminum companies’ shares rose on Monday after President Donald Trump raised the metal's tariffs to 50%.

Chicago-based Century Aluminum’s (CENX) stock jumped 21% while Kaiser Aluminum's (KALU) stock rose 4.1%.

Last week, Trump doubled the tariffs on aluminum and steel to 50%, under his signature “America First” policy to boost domestic manufacturing in the U.S.

According to commerce department data, the U.S. imported $17.7 billion worth of aluminum products in 2024, slightly lower than the previous year but still higher than pre-pandemic levels. The bulk of the aluminum originated from Canada, with the two countries establishing integrated supply chains across various industries.

On Monday, Century Aluminum lauded Trump’s fresh set of tariffs. The company is set to construct the first new aluminum smelter in the U.S. in 50 years and double domestic production.

However, the fresh set of tariffs heightened the risks of a further escalation in the global trade war. Several countries, including the U.S. allies, criticized the raise amid ongoing trade deal negotiations.

“Unwinding the efficient, competitive, and reliable cross-border supply chains like we have in steel and aluminum comes at a great cost to both countries,” Candace Laing, president of the Canadian Chamber of Commerce, said, according to a Financial Post report.

Another aluminum firm, Alcoa’s (AA) stock edged lower. Pittsburgh-based Alcoa has operations worldwide, including in Canada and Australia.

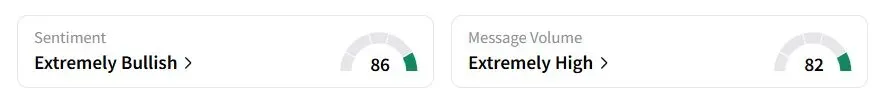

Retail sentiment about Century Aluminum on Stocktwits was in the ‘extremely bullish’ (86/100) territory, while retail chatter was ‘extremely high.’

Century Aluminum stock is up 1.5% year to date (YTD), and Kaiser Aluminum stock has gained 6.4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2203832195_jpg_d80f13d1c7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740483_jpg_28cc9c7ce9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250929477_jpg_725f832b99.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2250993932_jpg_77e7b26c88.webp)