Advertisement|Remove ads.

Chevron Buys 5% Stake In Hess Corp, Remains Confident About Pending Consummation Of Acquisition: Retail Sentiment Improves

Shares of oil companies Chevron Corp (CVX) and Hess Corp (HES) traded in the green on Monday after the former indicated it had acquired a nearly 5% stake in Hess at prevailing market prices in open market transactions.

In an exchange filing, Chevron said it purchased 15.38 million shares of Hess Corporation between January and March 2025, representing approximately a 4.99% stake in the company. Based on Monday’s price of $150, Chevron’s latest stake acquisition is worth $2.3 billion.

The stake purchase was conducted at prices at a discount to the price mentioned in Chevron’s merger agreement from October 2023.

Back then, Chevron had entered into a definitive agreement with Hess Corporation to acquire all of Hess's outstanding shares in an all-stock transaction valued at $53 billion, or $171 per share.

The company highlighted that the acquisition of Hess upgrades and diversifies its already advantaged portfolio. “The Stabroek block in Guyana is an extraordinary asset with industry-leading cash margins and low carbon intensity that is expected to deliver production growth into the next decade,” the company stated.

Chevron said that the latest stake purchase reflects its continuing confidence in the consummation of the pending acquisition of Hess.

According to a Bloomberg report, soon after the deal was agreed upon, Exxon filed for arbitration, claiming it had a right of first refusal over Hess’s Guyana stake.

However, Chevron argues that the right does not apply in the case of a corporate merger. The case will be heard in May and a decision is expected by September, the report added.

Chevron also stated that the purchases of Hess shares are in addition to repurchases of the company’s common stock being made for the first quarter ending March 31, 2025.

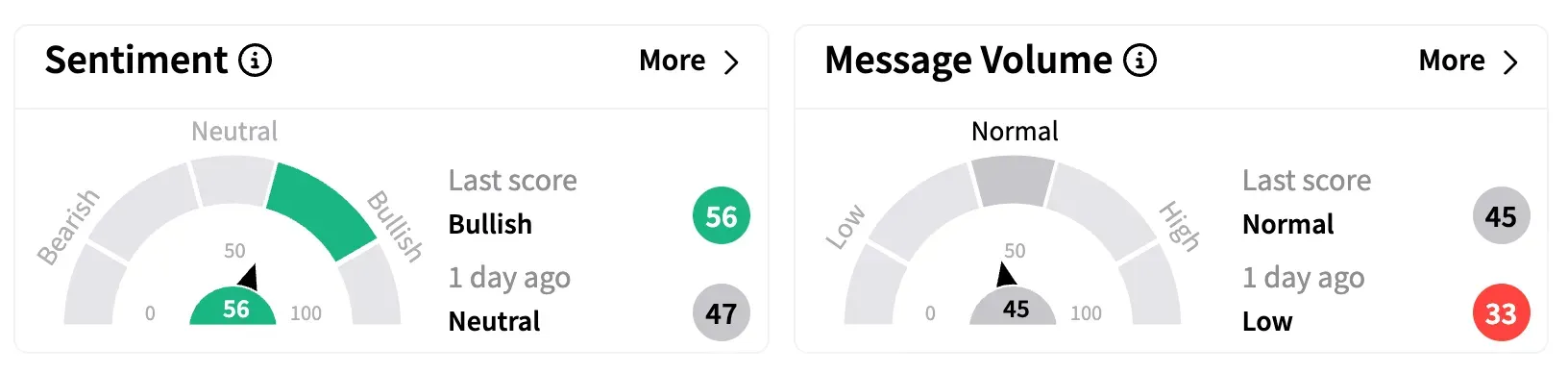

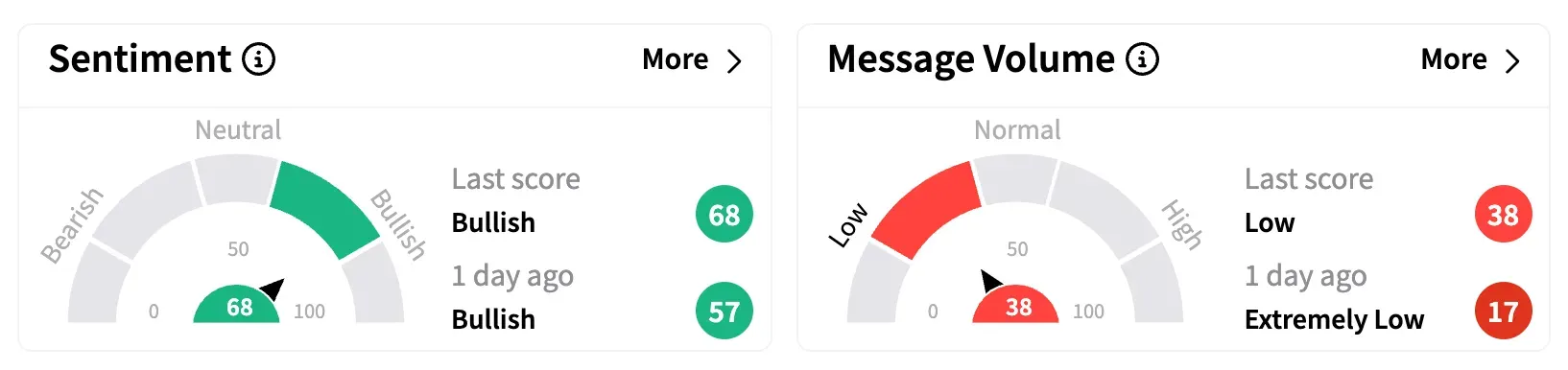

On Stocktwits, retail sentiment surrounding CVX stock flipped into the ‘bullish’ territory (56/100), while for HES shares, sentiment climbed further into the ‘bullish’ (68/100) territory.

CVX shares have gained nearly 8% this year, while HES shares have risen over 10% in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)