Advertisement|Remove ads.

Affirm Stock Tumbles Pre-Market After Klarna Replaces Company As Walmart’s Fintech Partner: Retail Stays Bearish

Shares of financial services company Affirm Holdings Inc (AFRM) tumbled over 6% in Monday’s pre-market session after Swedish fintech firm Klarna disclosed it will be partnering with consumer finance app OnePay to exclusively offer installment loans for purchases at Walmart in the United States.

The development is considered a negative for Affirm, which, in 2019, partnered with Walmart to offer shoppers the option of using the company’s services to pay for their purchases over time at nearly 4,000 Supercenters nationwide.

Affirm was available as a payment option on purchases ranging from $150 to $2,000.

Meanwhile, Klara pointed out that its partnership will give Walmart’s millions of weekly U.S. customers and members flexible payment options.

OnePay, backed by Walmart and Ribbit Capital, is already integrated into Walmart’s physical and digital channels. Walmart U.S. customers can shop using OnePay installment loans powered by Klarna.

Once approved, customers can choose from a range of repayment terms, from three to 36 months.

Klarna CEO Sebastian Siemiatkowski said OnePay's choice of Klarna as its exclusive installment loans partner at Walmart in the U.S. is a huge vote of confidence.

The firm’s disclosure about its partnership comes when it is on its way to go public.

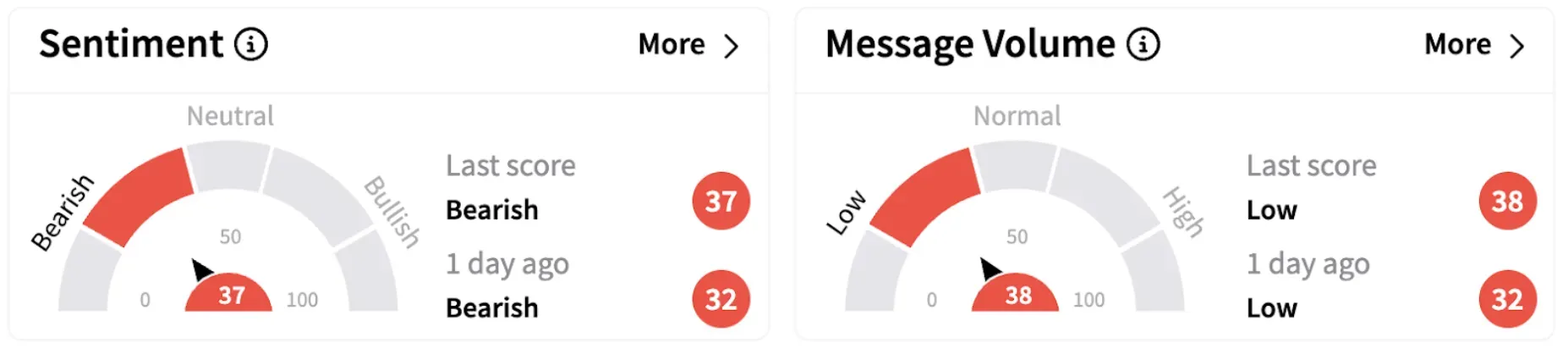

On Stocktwits, retail sentiment surrounding Affirm continued to trend in the ‘bearish’ territory.

Most user comments on Stocktwits surrounding AFRM ticker reflected a pessimistic take on the stock.

AFRM shares have lost nearly 7% in 2025. The stock has gained over 46% in the past 12 months.

Also See: Coda Octopus Expected To Post Revenue Growth In Q1, But Retail’s Not Sure Yet

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227347257_jpg_81c3539d3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2204003106_jpg_405e036a7c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_peter_tuchman_jpg_fb781e7355.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_85ede3fab5.webp)