Advertisement|Remove ads.

Chevron Unveils 2030 Plan: Higher Oil Output, AI Power Push, And $20B Annual Buybacks

- Chevron expects to increase contributions from Hess to $1.5 billion by 2026.

- Chevron aims to repurchase shares for $10 - $20 billion annually through 2030.

- The company’s first AI data center power project in West Texas is expected to be online by 2027.

Chevron Corporation (CVX) unveiled its five-year strategic plan through 2030, focusing on cash flow growth and expansion into power solutions to support artificial intelligence (AI) data centers. The energy giant also plans to return up to $20 billion a year to shareholders through buybacks and dividends.

Chevron said it expects oil and gas production to grow 2% - 3% annually through 2030, increase contributions from Hess to $1.5 billion, and achieve structural cost savings of $3 billion to $4 billion by the end of 2026. The company also reduced its capital expenditure (capex) guidance range to $18-$21 billion per year from the previous guidance of $19 billion-$22 billion.

The company announced plans to “maintain capital and cost discipline”, targeting a capex and dividend breakeven even if Brent prices fall below $50 per barrel and improving return on capital employed (ROCE) by over 3% by 2030 at $70 a barrel.

Chevron also aims to strengthen shareholder value by maintaining consistent dividends and repurchasing shares for $10 - $20 billion annually through 2030. The company has repurchased shares in 18 of the last 22 years.

“We believe Chevron is uniquely positioned to grow earnings and free cash flow into the next decade. Never in my career have I seen a higher confidence outlook, further into the future and with lower execution risk,” said Mike Wirth, Chevron’s chairman and CEO.

West Texas AI Data Center Power Project

The oil firm is pursuing “pragmatic, returns-driven” investments in New Energies, including a large-scale power project in West Texas to supply energy for expanding data centers, as well as initiatives in renewable fuels, hydrogen, carbon capture and storage (CCUS), and lithium. Its first AI data center power project in West Texas is expected to be online by 2027.

Stock Watch

CVX stock was down 0.19% at $155.95 in premarket trade on Wednesday.

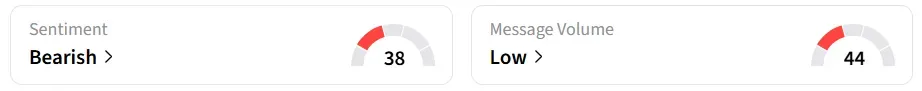

Retail sentiment on Stocktwits has remained in the ‘bearish’ territory for the past 24 hours.

On a year-to-date basis, the shares have climbed 7.4%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)