Advertisement|Remove ads.

Cidara Therapeutics’ Market Cap Doubles After Investigational Drug Shows Positive Results In Preventing Influenza In Mid-stage Trial

Cidara Therapeutics, Inc. (CDTX) on Monday announced positive results from its mid-stage trial evaluating CD388 for the prevention of seasonal influenza in healthy unvaccinated adults aged 18 to 64.

Cidara’s shares nearly doubled in value as of Monday afternoon.

Single doses of 450mg, 300mg, and 150mg of CD388 conferred 76%, 61%, and 58% protection, respectively, from symptomatic influenza over 24 weeks compared to placebo, the company said. The doses were administered at the beginning of the flu season.

CD388 was well-tolerated at all doses with no unexpected dose-limiting treatment-emergent adverse events observed, the company added.

CD388 is not a vaccine. Instead, it is an investigational drug-Fc conjugate (DFC), or low molecular weight biologics, which are designed to function as long-acting small molecule inhibitors.

As it is not a vaccine, its activity is not reliant on an immune response and, thereby, is expected to be efficacious in individuals regardless of immune status.

CEO Jeffrey Stein stated that the trial results reinforce the company’s confidence in the potential of CD388 to provide seasonal protection against influenza A and B.

Cidara stated that it has submitted a request to the U.S. Food and Drug Administration to review the results of the mid-stage trial and discuss the design and timing of a late-stage trial.

Following the update, H.C. Wainwright raised its price target on Cidara to $53 from $41 and kept a ‘Buy’ rating on the shares.

The new price target implies a 152% upside to the stock’s closing price on Friday.

The analyst further increased the probability of success for CD388 to 75% from 60% based on the positive mid-stage trial data.

RBC Capital also raised the firm's price target on Cidara Therapeutics to $75 from $35 while keeping an 'Outperform' rating on the shares. The results from the recent study position CD388 as a potential groundbreaking, long-acting flu preventative that could combine and enhance the benefits of existing vaccines and prophylactics, it said.

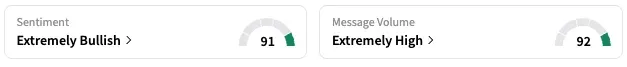

On Stocktwits, retail sentiment around Cidara soared from ‘bearish’ to ‘extremely bullish’ territory over the past 24 hours while message volume increased from ‘normal’ to ‘extremely high’ levels.

A Stocktwits user highlighted the company’s debt-free status and strong cash position.

Cidara ended the first quarter with $174.5 million in cash, cash equivalents, and restricted cash.

CDTX stock is up by about 56% this year and by about 272% over the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2208530303_jpg_bfa7565aeb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2214351115_jpg_9770916730.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233055465_jpg_bdb4b6472f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1251437157_jpg_2ebb5f0c8e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)