Advertisement|Remove ads.

Cigna Stock Slips On More Price-Target Cuts After Weak Q4, But Retail Bets On A Rebound

Shares of The Cigna Group traded about 0.8% lower in volatile action Monday morning as Wall Street analysts continued to slash price targets following last week's disappointing fourth-quarter earnings miss.

However, retail sentiment remained strong, indicating traders are betting on a rebound.

According to The Fly, TD Cowen analyst Charles Rhyee lowered his price target on Cigna to $380 from $391 while maintaining a 'Buy' rating, citing continued upside from strong specialty trends despite the weak quarter.

Piper Sandler analyst Jessica Tassan cut her price target to $348 from $394, keeping an 'Overweight' rating. The brokerage attributed Cigna's Q4 earnings miss to a rise in high-cost claimants within its Stop-Loss segment.

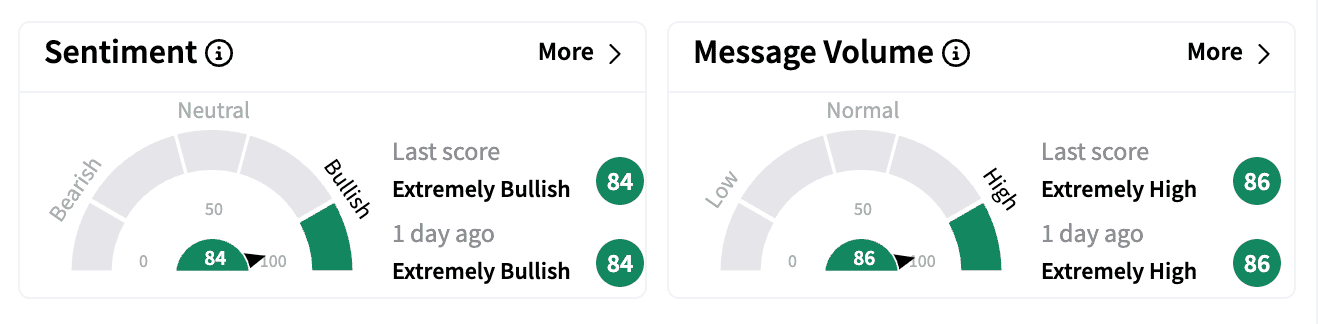

Despite the fresh price-target cuts, sentiment on Stocktwits remained 'extremely bullish,' suggesting retail investors have been buying the dip.

Cigna shares have climbed more than 5% since last week's earnings report, with many retail traders arguing the stock is oversold and offers an attractive entry point.

According to Koyfin data, the health insurer's stock trades 25% below analysts' average price target of $367.87. Shares are up 4.6% year-to-date.

In a separate announcement Monday, Cigna said it will begin linking executive compensation to customer satisfaction, pledging to streamline access to care by making the process "simpler, easier, and faster."

The company plans to implement governance changes to improve accountability and will publish an annual customer transparency report starting next year.

The move comes weeks after UnitedHealth CEO Brian Thompson was shot and killed in New York City, reigniting debates over the state of U.S. health care.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_anthropic_OG_jpg_51bd14bc5d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2233516954_jpg_72241a7246.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_tanker_resized_jpg_bb40d4bd7e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_CEO_OG_jpg_e773f9395c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_543225021_jpg_d5737b0d33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2173218234_fotor_2025021091559_3d9884379a.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)