Advertisement|Remove ads.

Cisco Analysts Brace For Q1 Beat As Spending Environment Improves: Retail Mood Buoyant

Networking giant Cisco Systems, Inc. ($CSCO) is scheduled to report its fiscal 2025 first-quarter results after the market closes on Wednesday.

Analysts, on average, expect the San Jose, California-based company to report non-GAAP earnings per share (EPS) $0.87 and revenue of $13.78 billion. This marks a decline from the year-ago quarter’s $1.11 and $14.7 billion, respectively

Morgan Stanley analyst Meta Marshall expects a small top-line beat as results from peers and checks show a gradual improvement in spend environment amid dissipation in “inventory digestion” headwinds

The analyst predicts that Cisco stock will move higher following the print, catalyzed by strong orders. She models a 30% year-over-year (YoY) increase in organic orders.

But Splunk synergies or networking pull-through from a stronger security portfolio would be needed for meaningful upside, the analyst said.

Cisco completed its $28 billion all-cash acquisition of data analytics and intelligence software company Splunk in mid-March.

Marshall expects upside relative to EPS expectations due to RIG/Splunk synergies.

Morgan Stanley has an “Overweight” rating and $58 price target for Cisco shares.

On Tuesday, JP Morgan analyst Samik Chatterjee upgraded Cisco shares from “Neutral” to “Overweight” and upped the price target from $55 to $66. The analyst premised his optimism on the recovery cycle in enterprise networking demand, the recent investment in the security segment and the stock trading off its peak valuation multiple.

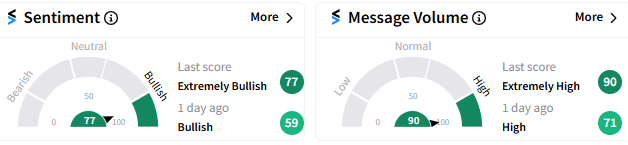

Retail mood is “extremely bullish” (77/100) on Stocktwits platform, with message volume spiking to “extremely” high.

As of 11:50 am ET, Cisco shares edged up 0.09% to $58.76.

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_changpeng_zhao_binance_CEO_OG_jpg_1f2a158765.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2263411662_jpg_efc7c78da8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2213700945_jpg_100e788722.webp)