Advertisement|Remove ads.

Tesla Stock Rebounds As Trump Taps Elon Musk For Government Efficiency Role: Analyst Hails ‘Poker Move For Ages’, Retail Holds Back

Tesla, Inc. ($TSLA) made a comeback after the stock plummeted over 6% on Thursday, as traders react positively to President-elect Donald Trump appointing Elon Musk as the Co-Chair of the newly setup Department of Government Efficiency (DOGE) and an in-line October consumer price inflation report.

In premarket trading, as of 10:15 am ET, Tesla stock was seen rising 0.79% to $330.80.

In a statement released late-Tuesday, Trump said, "I am pleased to announce that the great Elon Musk, working in conjunction with American patriot Vivek Ramaswamy, will lead the Department of Government Efficiency."

DOGE, which will provide advice and guidance from outside of the government, aims to dismantle government bureaucracy, slash excess regulations, cut wasteful expenditures and restructure federal agencies, he said.

Trump also gave a timeline for accomplishing the objectives. “Their work will conclude no later than 2024,” he said.

Commenting on the new appointment, Wedbush analyst and Tesla-bull Daniel Ives said Musk will have a "massive role in the Trump White House with his increasing reach clearly across many federal agencies."

Given the role is not an official cabinet or U.S. government position, it is unlikely to impact Musk’s CEO roles at Tesla and SpaceX, he said.

“We would also expect Musk to have a key role on many of the new AI initiatives within the government (AI Ambassador) as well as China tariff discussions over the coming months as Trump gets ready to take the Oval Office in January,” Ives said.

The analyst sees positive implications for Tesla as Trump will likely fast-track the autonomous and AI initiatives over the next 12 to 18 months. This will be a game-changer to the Tesla story, he added.

Musk’s bet on Trump is a "poker move for the ages," said Ives.

The analyst has an ‘Outperform’ rating and $400 price target for Tesla shares.

Retail sentiment toward the stock was downbeat despite Musk’s DOGE appointment.

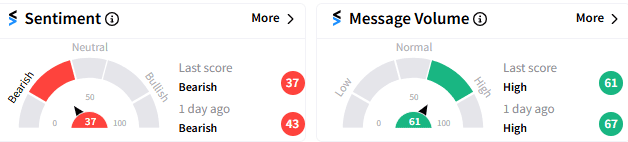

The sentiment meter on Stockwits pointed to "bearish" mood toward the stock (37/100), although message volume was "high."

While a user on the Stocktwits platform said the stock could rebound toward $345-$350, another called for shorting the stock.

Read Next: ZoomInfo Stock Plunges Despite Q3 Beat As Traders Fret Over Shrinking Revenue: Retail Remains Wary

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244602965_jpg_cba2d012d5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_novaxovid_novavax_resized_jpg_3a4b0527ae.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ripple_OG_jpg_e47a5108f1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1321753430_jpg_3be244e72e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2261740807_jpg_19c077b8cd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)