Advertisement|Remove ads.

Cisco Stock Climbs To 24-Year Highs In Pre-Market On Q2 Earnings Beat, Barclays Hikes Price Target On Strong Networking Demand: Retail's Bullish

Shares of Cisco Inc. (CSCO) surged more than 6% in pre-market trade on Thursday after the networking giant’s second-quarter (Q2) earnings came ahead of expectations.

Cisco’s shares were hovering at $66.30 at the time of writing, surging to over 24-year highs.

Aiding Cisco’s stock this morning was a price target hike from analysts at Barclays. The brokerage hiked its price target to $61 for Cisco’s shares, up from $56, according to TheFly.

Cisco’s stock has already crossed this level in pre-market trading and is up by over 9% from Barclays’ price target.

The brokerage maintained its ‘Equal Weight’ rating on the stock, highlighting that the company’s solid second-quarter earnings were based on broad-based strength, led by networking demand and growth in orders.

Cisco posted earnings per share (EPS) of $0.94 during the quarter, ahead of the expected $0.91, according to Stocktwits data.

It also eked past revenue estimates of $13.87 billion, posting a topline of $14 billion.

In its guidance, the networking behemoth pegs EPS to be in the range of $0.90 and $0.92, against an estimate of $0.90. It expects revenue between $13.9 billion and $14.1 billion, ahead of an estimated $13.88 billion.

"As AI becomes more pervasive, we are well positioned to help our customers scale their network infrastructure, increase their data capacity requirements, and adopt best-in-class AI security,” said Cisco CEO Chuck Robbins.

Cisco also said its acquisition of Splunk, a business and web analytics company, contributed to its earnings ahead of the planned schedule.

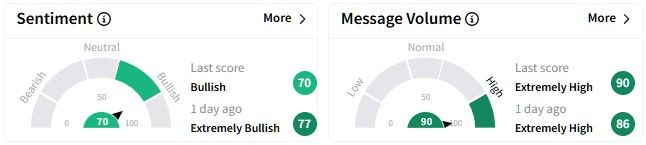

Retail sentiment on Stocktwits around the Cisco stock was in the ‘bullish’ (70/100) territory, while message volume surged to hover at ‘extremely high’ levels.

Cisco’s stock has gained nearly 38% in the past six months and a relatively more modest 26% gain over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Also See: NXP Semiconductors Stock Gains On Morgan Stanley’s Upgrade, But Retail’s Feeling Bearish

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)