Advertisement|Remove ads.

Citigroup In Spotlight After Allotting More Money To Cover Potential Losses On Loans

Citigroup (C) stock was in focus on Tuesday after the bank said it would keep millions of dollars more than in the previous quarter in reserves to cover any potential losses.

“Given the macro environment, etc., cost of credit compared to last quarter, we expect to be up a few hundred million,” Vis Raghavan, Citigroup’s head of banking, said at a Morgan Stanley conference.

Lenders set aside a specific amount of money to cover future risks, which include changes in macroeconomic conditions or increased lending activity.

Raghavan’s cautious commentary comes when global trade tensions have raised concerns over the global economy. Citi is a major player in the personal banking sector and one of the top credit card issuers in the U.S.

According to a report by S&P Global, U.S. banks recorded lower-than-estimated provisions for credit losses in the first quarter despite macroeconomic uncertainties.

Raghavan assured investors that the bank’s credit quality was good. Eighty percent of its corporate credit exposure was high grade, and the number was much higher in international markets.

Citi’s equities and fixed-income desk trading have been robust and are expected to rise mid- to high-single-digit percentage points compared to the year-ago quarter, he said, before adding that investment banking fees are expected to increase mid-single-digit percentage points.

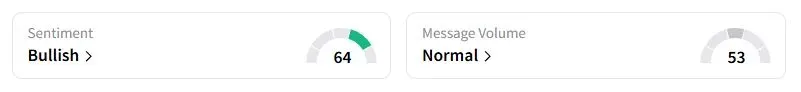

Retail sentiment on Stocktwits was in the ‘bullish’ (64/100) territory, while retail chatter was ‘normal.’

Citi stock has gained nearly 10% this year.

Last week, Citi said it would cut 3,500 jobs in China to reduce costs.

Also See: eToro Stock Slips After Touching Record Highs As Q1 Profit Falls: Retail’s Split

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_cathiewood_OG_jpg_a3c8fddb3f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Micron_jpg_7058d4986a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2249765235_jpg_8d9471024c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Getty_Images_2185805420_fotor_2025011795638_6fbb0bb63f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_us_stocks_jpg_64b4ea4fc0.webp)