Advertisement|Remove ads.

Clorox Stock In Focus After Q2 Earnings Beat, Raised EPS Outlook: Retail Stays Bullish

Shares of household products company Clorox Co. ($CLX) slid 2.6% in after hours trading on Monday after having risen earlier in the day following better-than-expected second-quarter earnings, with retail sentiment inching up.

The company posted earnings per share of $1.55, beating estimates of $1.40 quoted by Wall Street analysts. Its revenues stood at $1.69 billion, above the $1.63 billion expected by analysts, according to Stocktwits data.

However, its net sales declined 15% year-on-year compared to a 16% increase in the year-ago quarter, the company said. The decrease was primarily driven by the impact of retail inventory restoration following the August 2023 cyberattack and the divestitures of the VMS and Argentina businesses, the company said.

"We achieved better-than-expected results across sales, margin and EPS in the second quarter due to our strong demand creation plans, which also supported our share growth," Linda Rendle, Clorox’s chair and CEO, said. "We are further advancing our transformation as we embark upon a significant milestone with our enterprise resource planning transition in the U.S., resulting in our updated outlook. I am confident that we are taking the right actions to deliver strong financial performance and long term, profitable growth."

For fiscal 2025, it expects net sales to be down 1% to up 2%, including one to two points of benefit from incremental shipments related to the enterprise resource planning (ERP) transition, which is expected to reverse in the front half of the next fiscal year. Its organic sales are now expected to be up 4% to up 7%, it added.

Adjusted EPS is now expected to be between $6.95 and $7.35 compared to the previous estimate of $6.65 and $6.90, a year-over -year rise of 13% to 19%, respectively.

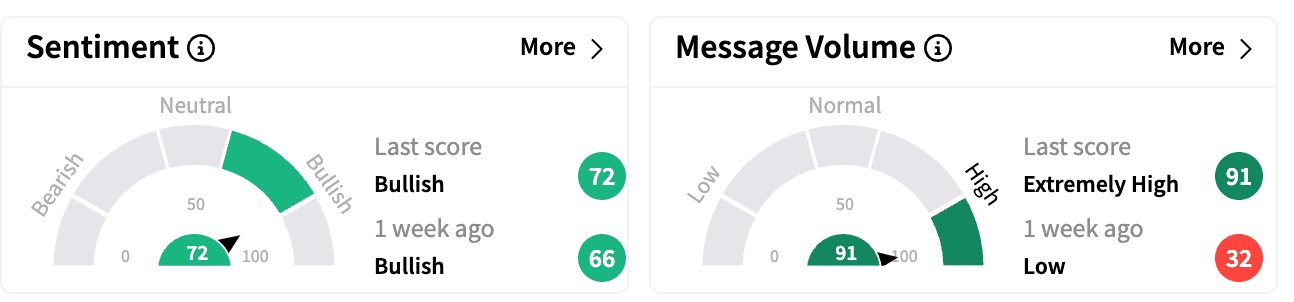

Sentiment on Stocktwits was ‘bullish,’ albeit at a higher degree compared to last week. Message volumes jumped to ‘extremely high’ from ‘low’

Separately, Clorox intends to acquire P&G's 20% interest in the Glad bags and wraps joint venture venture with P&G next year..

In the statement, Clorox and P&G have jointly decided to wind down the Glad bags and wraps joint venture on Jan. 31, 2026.

Clorox stock is down 1.62% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2238161001_jpg_d763653491.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2202902434_jpg_34a840ada1.webp)