Advertisement|Remove ads.

Coal India Trades Near Support: SEBI RA Karanraj Sonkusale Says ₹513 Possible On ₹374 Reversal Signal

Shares of Coal India are trading near key support levels, with a potential bullish setup suggesting an upside target of ₹513, according to SEBI-registered research analyst Karanraj Sonkusale.

The analyst said the stock looks “good” on weekly charts and may move higher if it holds support and shows confirmation of reversal.

At the time of writing, shares of Coal India were trading 0.78% higher at ₹386.30.

Coal India’s stock closed at ₹383.30 on Wednesday and is hovering near immediate support at ₹377.08. Technical indicators offer a mixed picture.

The Relative Strength Index (RSI) stands at 44.78, indicating neutral momentum, while the Moving Average Convergence Divergence (MACD) is negative at -1.11, suggesting short-term bearishness.

Coal India is currently trading below short-term exponential moving averages, with EMA5 at ₹392.72 and EMA7 at ₹393.74.

Sonkusale said a bullish trade could be initiated in the ₹374–₹394 zone if confirmation signals such as bullish candlestick patterns or volume spikes emerge.

He set a stop-loss below ₹360 and expects a potential upside toward ₹513, a historical resistance level.

He added that sustaining above ₹374 with bullish confirmation improves the probability of a breakout.

In the first quarter of FY2025, the company reported a consolidated net profit of ₹109.59 billion, beating analyst expectations.

The result was supported by a 6.2% increase in sales volumes and a 5% drop in employee costs, which helped offset a 5.5% decline in coal prices.

For the full year FY2024, Coal India reported revenue of ₹1.42 trillion and net profit of ₹374.02 billion. Its EBITDA margin stood at 34.2%, return on equity at 40.27%, and dividend yield at 6.65%.

The company also maintains a debt-to-equity ratio of 0.076.

Key levels to watch include immediate support at ₹377.08 and major support at ₹369.77, while resistance is seen at ₹396.03 and ₹407.67, according to Sonkusale.

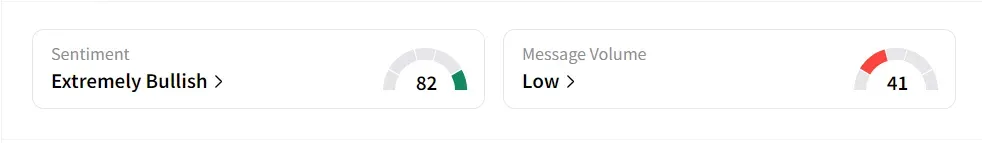

On Stocktwits, Sentiment was ‘extremely bullish’ amid ‘low’ message volume.

Shares of Coal India have declined 0.03% so far this year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sandisk_jpg_920fcc1fc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2156649816_jpg_bde9d5ac58.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)