Advertisement|Remove ads.

Coca-Cola Stock In Focus After Q3 Earnings Top Estimates: Here’s What Retail Thinks

Coca-Cola Co ($KO) shares were in focus on Wednesday after the firm reported its third quarter earnings that topped Wall Street estimates.

Revenue came in at $11.95 billion compared to a Wall Street estimate of $11.60 billion while earnings per share (EPS) came in at $0.77 versus an estimated $0.74.

Net income attributable to shareholders stood at $2.85 billion versus $3.09 billion in the same quarter a year earlier.

CEO James Quincey said the firm is encouraged by its year-to-date performance and the system’s ability to manage near-term challenges while also remaining focused on long-term growth opportunities.

Operating margin, which includes items impacting comparability, came in at 21.2% versus 27.4% in the prior year. The beverage maker attributed the decline to factors affecting comparability, including a $919 million charge for re-measuring the contingent consideration liability tied to the 2020 fairlife acquisition, along with currency headwinds.

The firm’s unit case volume declined 1% with growth led by Brazil, the Philippines and Japan getting offset by declines in China, Mexico and Turkey.

For the fourth quarter, the firm expects comparable EPS (non-GAAP) percentage growth to include an approximate 10% currency headwind based on the current rates and including the impact of hedged positions. This is in addition to a 3% to 4% headwind from acquisitions, divestitures and structural changes, it said.

For the full-year 2024, the company expects to deliver organic revenue (non-GAAP) growth of approximately 10%, which factors-in anticipated pricing impact of a number of markets experiencing intense inflation. It expects to deliver comparable currency neutral EPS (non-GAAP) growth of 14% to 15% versus a previous forecast of 5% to 6%.

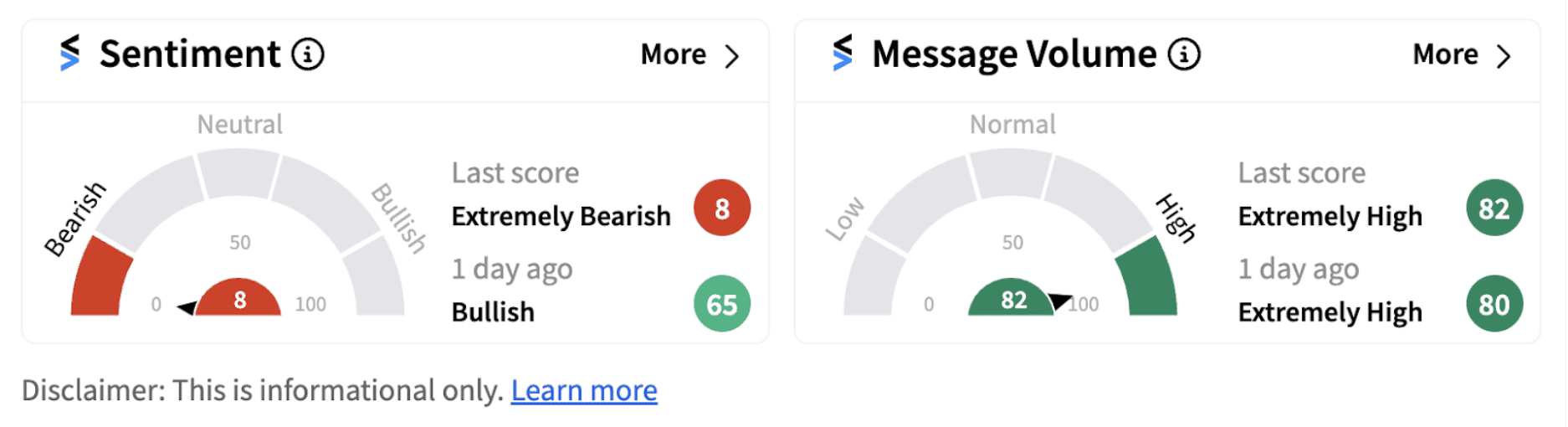

Despite the upbeat earnings, retail sentiment on Stocktwits dipped into the ‘extremely bearish’ territory (8/100) from ‘bullish’ a day ago, accompanied by extremely high message volume.

One Stocktwits user expressed skepticism on the firm’s ability to raise prices.

Coca-cola shares have risen over 16% on a year-to-date basis, underperforming the benchmark U.S. indices.

Also See: Starbucks Stock Slips After Preliminary Earnings, 2025 Guidance Suspension: Retail Sentiment Weakens

For updates and corrections email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2231279747_jpg_9150b71435.webp)