Advertisement|Remove ads.

Cochin Shipyard Rises On ONGC Order Win; SEBI Analyst Sees Nearly 10% Upside Potential

Cochin Shipyard shares rose 2% intraday on Thursday following another order win.

It bagged an order worth ₹200 crore from Oil and Natural Gas Corporation Limited (ONGC) for dry dock or major lay-up repairs of jack-up rigs. The project will be executed within 12 months, the shipbuilding company said in a regulatory filing.

In July, the defense firm had signed an MoU with HD Korea Shipbuilding & Offshore Engineering (KSOE) for long-term shipbuilding and maritime development collaboration.

Cochin Shipyard’s order book is valued at approximately ₹21,000 crore as of August 2025, with the majority (around ₹13,700 crore) from the defense sector.

Technical Watch

On the technical front, Ashok Kumar Aggarwal of Equity Charcha noted that its Relative Strength Index (RSI) was above 60, and the stock was trading above all moving averages. Its daily time frame chart showed strength and accumulation for the short term.

Short Term Trade Strategy

He recommended buying at ₹1,890-₹1,900, with a stop loss at ₹1,785 for target prices of ₹2,020-₹2,090.

What Is The Retail Mood?

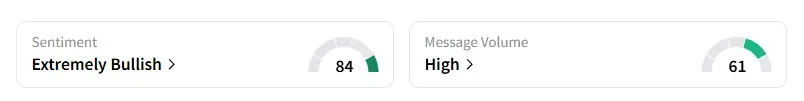

Data on Stocktwits shows that retail sentiment has been ‘extremely bullish’ for a week amid ‘high’ message volumes.

Defense stocks have seen a good run this year. Cochin Shipyard has delivered 24% returns year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250929484_jpg_8206df84ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2177851484_jpg_b969f68c05.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rocketlab_resized_jpg_92c1a02a7f.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2201668075_jpg_cae68c6d02.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)