Advertisement|Remove ads.

Coforge Earnings Preview: SEBI RA Sees Buying Opportunity Even As Near-Term Charts Flash Caution

Coforge is expected to report a significant increase in top and bottom-line quarterly figures on Wednesday. According to reports, the IT services company’s net profit is estimated to more than double in Q1FY26, while sales are expected to grow between 40% and 55% on an annual basis.

Ahead of the results, the stock was trading marginally lower at ₹1,853.30.

From a technical standpoint, Coforge is showing signs of short-term weakness, struggling to clear a minor resistance zone on the hourly chart, said SEBI-registered analyst Deepak Pal.

The stock remains below its 20-day and 50-day exponential moving averages (EMA), while the 100 EMA acts as a key resistance, reinforcing the lack of bullish momentum. On the daily timeframe, it faces pressure near the 14-day EMA around ₹1,900, Pal added.

The analyst believes that a decisive breakout above the ₹1,875 ₹1,885 range is essential for any sustained upward move. On the downside, the ₹1825 - ₹1830 zone serves as immediate support.

If Coforge stock dips toward the ₹1,820-₹1,825 range, it could present a buying opportunity; however, a strict stop-loss at ₹1,790 should be placed, the analyst recommended.

However, technical indicators, including the Parabolic SAR, moving average convergence/divergence (MACD), and the relative strength index (RSI), suggest caution, with bearish bias and limited upside strength unless a breakout occurs, Pal said.

Coforge operates globally across key verticals like BFSI, healthcare, and the public sector, with a growing focus on digital transformation, cloud, automation, and AI-based solutions.

Its operational figures are promising. Coforge has consistently posted revenue growth and healthy operating margins of 15 - 18%, supported by strong client retention and a robust order book.

While near-term risks include macroeconomic uncertainties and currency volatility, Coforge’s solid financials, stable promoter holding, and long-term digital demand position it well for sustained growth, the analyst said.

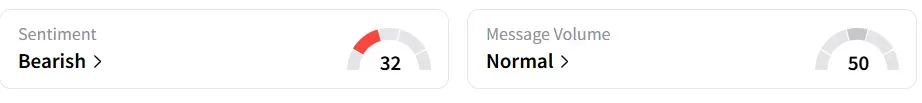

Retail sentiment on Stocktwits remained ‘bearish’, tracking the stock’s weak outlook in the short term.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227231024_jpg_227a7ced1a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2243387433_jpg_9712a99e81.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_JP_Morgan_35e13f3155.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_exchange_original_2_jpg_cf429881e7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_chart_falling_resized_jpg_c0ce61eff2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232147543_jpg_a7d6168b5c.webp)