Advertisement|Remove ads.

Coforge Hits 2-Month Low Post Q1 Earnings: SEBI RAs Flag Bearish Momentum

Coforge shares declined over 7% on Thursday, marking the third consecutive session of losses. The stock touched its lowest level since May 28, despite steady June quarter (Q1FY26) earnings.

Q1 net profit rose 21% on a quarter-on-quarter basis to ₹317 crore, lower than the estimated profit of around ₹335 crore. Revenues rose 8% to ₹3,689 crore. Its orderbook rose 47% to $1.55 billion year-on-year (YoY).

SEBI-registered analyst Akhilesh Jat observed that the stock had seen a strong rally earlier, and the sharp upmove may have already factored in the positive earnings momentum. As a result, the marginal miss appears to have triggered profit-booking. The disappointment, though not steep in absolute terms, seems to have weighed on market expectations, he added.

In 2025, Coforge has exhibited high price volatility. After adjusting for the split and bonus, the stock fell from ₹2,005 (Dec 2024 peak) to ₹1,194 in April 2025 (down nearly 40.5%) before recovering to ₹1,994, and then slipping below ₹1,700 again.

According to Jat, ₹1,630–₹1,550 may act as support, while ₹1,830–₹1,900 could be seen as a resistance zone for Coforge.

Analyst Sunil Kotak highlighted that its Relative Strength Index (RSI) broke below 40, indicating bearish bias. The stock was trading with huge volumes, he added.

Kotak identified support at ₹1,625-₹1,655 and sees the possibility of retracement at these levels, noting that the momentum in the IT sector is bearish for the short term.

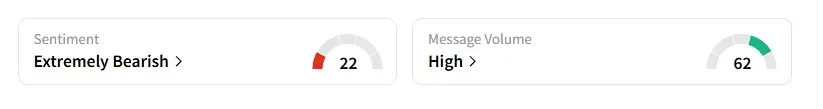

Data on Stocktwits shows that retail sentiment worsened, moving from ‘bearish’ to ‘extremely bearish’ a day ago amid ‘high’ message volumes.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Coinbase_c429427aa1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Ford_jpg_186fb0eaa9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)