Advertisement|Remove ads.

Coinbase Stock Soars After-Hours On S&P 500 Inclusion, Retail Eyes New Highs

Coinbase (COIN) stock soared 11% in extended trading on Monday after it was chosen to replace Discover Financial (DFS) in the S&P 500 index.

The cryptocurrency exchange would join the index before the opening of trading on May 19, S&P Dow Jones Indices said.

Another S&P 500 constituent, Capital One, is expected to complete the $35 billion acquisition of Discover on May 18 after receiving all the remaining regulatory approvals last month.

Coinbase would become the first crypto-related stock to be added to the index, which is seen as a bellwether of the U.S. economy. It would also find a deeper pool of investors as several funds track the S&P 500 and include the stock in their holdings.

The move comes after Bitcoin’s brief surge to $105,000 after a U.S.-China trade agreement, capping a volatile stretch after President Donald Trump's election win.

Once scorned in Washington, D.C., the digital assets industry has found an unlikely champion in Trump, who now aims to make the United States a global hub for cryptocurrency.

Coinbase CEO Brian Armstrong said on an X post that the inclusion signifies “crypto is here to stay.”

Last week, the company had agreed to acquire derivatives exchange Deribit in a $2.9 billion deal to bolster its position in the crypto options markets.

Microstrategy Chairman Michael Saylor congratulated Armstrong and said it was a major milestone for Coinbase and Bitcoin.

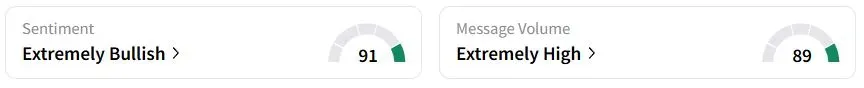

Retail sentiment on Stocktwits was in the ‘extremely bullish’ (91/100) territory, while retail chatter was ‘extremely high.’

One retail investor said it was still early to begin a long position in the stock, and it would go past $400.

Another user said the risk/reward for shorting the stock is “bad” after reminding Palantir’s gains following the inclusion.

Coinbase stock has fallen 19.2% year to date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2240747754_jpg_7dc7fe6446.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_es6_jpg_b768981c5a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228901180_jpg_0c2cc7dc28.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1232171389_jpg_55d81c88fb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Apple_jpg_b7abd92483.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)