Advertisement|Remove ads.

As SEC Prepares To Drop Coinbase Case, Brian Armstrong Quotes Bane From Dark Knight Rises: ‘You Merely Adopted The Dark, I Was Born In It’

Coinbase shares rallied over 2% after the company said on Friday it had reached an in-principle agreement with the Securities and Exchange Commission (SEC) to drop the ongoing litigation, subject to the commissioners' approval.

CEO and Co-founder Brian Armstrong said that once the agreement is approved by the Commission, which is expected next week, it will be a full dismissal and will carry no fines. There won’t be any changes to the firm’s business either.

In June 2023, the SEC filed a complaint in the U.S. District Court for the Southern District of New York against Coinbase Global, Inc. and Coinbase, Inc., alleging that Coinbase, Inc. had acted as an unregistered securities exchange, broker, and clearing agency.

On March 27, 2024, the District Court issued an order denying in part and granting in part Coinbase’s motion for judgment on the pleadings.

Coinbase later moved the District Court to certify the order for interlocutory appeal to the U.S. Court of Appeals for the Second Circuit. In January 2025, the District Court granted Coinbase’s certification motion for interlocutory appeal and ordered the proceedings in the District Court to stay pending resolution of the interlocutory appeal.

The company later filed its petition for interlocutory appeal in the Court of Appeals, while the SEC sought an extension to respond to the petition until March 14, 2025.

“This is hugely vindicating, especially because many people questioned my decision to engage in litigation with the SEC on this matter in 2023,” Armstrong said in his post on X.

The CEO said the SEC exceeded the authority given to them by Congress by asking the company to delist several assets that were not securities. He noted that caving into their demands would have destroyed the crypto industry in America.

“It was a bullying tactic, pure and simple, driven by Gensler's own political agenda. And if we had caved, it would have dramatically limited the scope of which crypto assets were allowed in the US and pushed the industry further offshore, into the shadows,” he said.

Armstrong noted that Coinbase’s fight would serve as a deterrent for future bad actors around the world. ‘We are comfortable engaging in litigation across multiple fronts indefinitely while continuing to build. This is business as usual. As Bain (sic.) in The Dark Knight says, "You merely adopted the dark; I was born in it.”

The Coinbase CEO is now looking to work productively with the SEC and expects the agency to reform under Paul Atkins, Mark Uyeda, Hester Peirce, DOGE, and more sensible new personnel coming into leadership roles.

“I commend the new leadership that is already in place for working to right this wrong - it's a great step in the right direction and took courage,” he said.

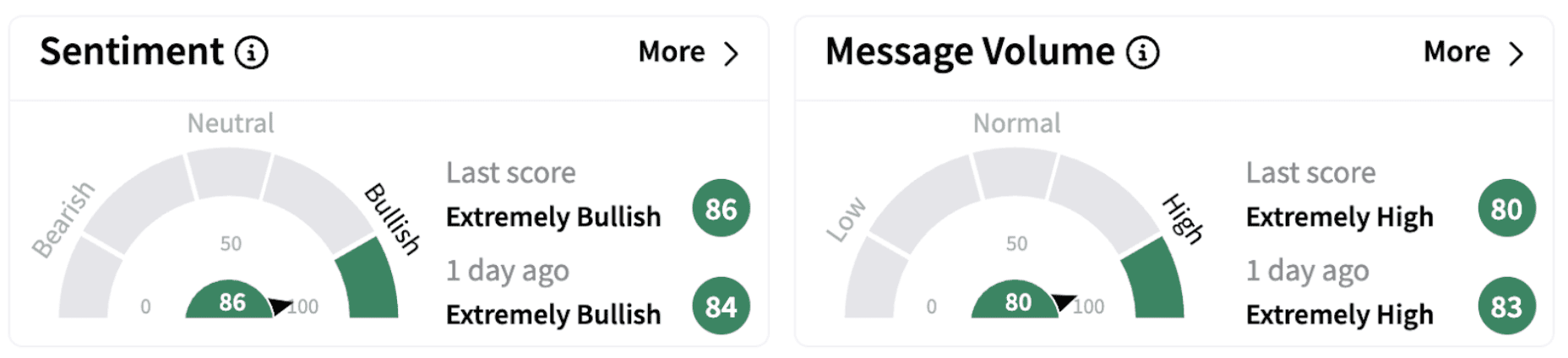

Meanwhile, on Stocktwits, retail sentiment climbed further into the ‘extremely bullish’ territory (86/100), accompanied by significantly high retail chatter.

Stocktwits users expressed optimism about the stock’s near-term prospects following the development.

COIN shares have gained over 2% in 2025 and over 62% over the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ionq_resized_jpg_35563ea1fb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_resized_may_jpg_bc23339ae7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_novavax_vaccine_resized_455cef63e9.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Array_Tech_b34d437c86.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)