Advertisement|Remove ads.

Grab Holdings Rises Pre-Market After JPMorgan Upgrades Stock To ‘Overweight:’ Retail Sees Great Prospects

Shares of Grab Holdings (GRAB) rose over 2% in Friday’s pre-market session after JPMorgan upgraded the stock to ‘Overweight’ from ‘Neutral’ with a $5.60 price target.

The price target reflects a 17% upside from current levels. The stock declined over 10% on Thursday after it reported weaker-than-expected earnings before interest, tax, depreciation, and amortization (EBITDA) and net income for the fourth quarter.

The Singapore-based company expects 2025 revenue between $3.33 billion and $3.40 billion on a constant currency basis. According to FinChat Data, the midpoint of the revenue outlook was below analysts’ expectations of $3.39 billion.

The company’s fourth-quarter revenue rose 17% to $764 million, topping the Wall Street estimate of $756.7 million.

According to a CNBC report, JPMorgan analyst Ranjan Sharma said the company’s guidance could prove conservative.

“With investor expectations anchored to the guidance, we believe earnings delivery over the year will likely drive positive revisions in earnings expectations,” the analyst wrote, according to the report.

“With a reduction in costs that can be passed on to consumers and initiatives to grow affordable services, we believe the growth in monthly transacting users (MTU) should expand the addressable market and grow mid-term earnings,” he added.

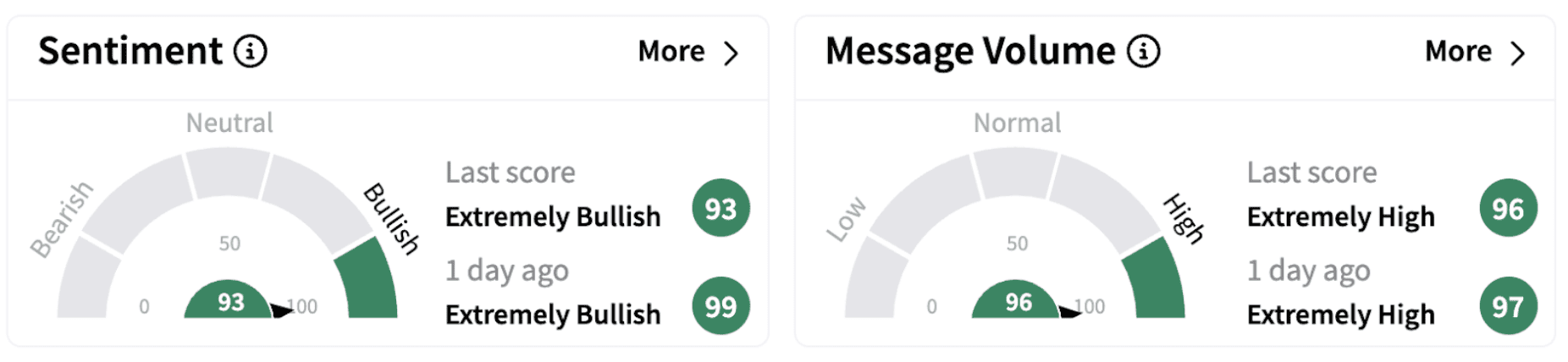

On Stocktwits, retail sentiment continued to trend in the ‘extremely bullish’ territory (93/100) accompanied by significantly high retail chatter.

Retail investors on Stocktwits highlighted the JPMorgan upgrade and expressed hope for the stock’s near-term prospects.

Grab shares have gained nearly 1% in 2025 and risen over 38% in the past year.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sharp_Link_Gaming_jpg_60ce5684e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243050664_jpg_37b52748e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_hims_stock_logo_resized_jpg_5554a2a2c1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Oil_drill_06147e8349.webp)